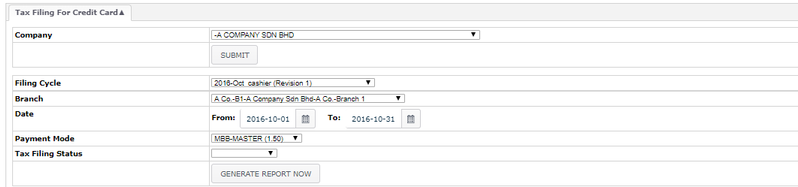

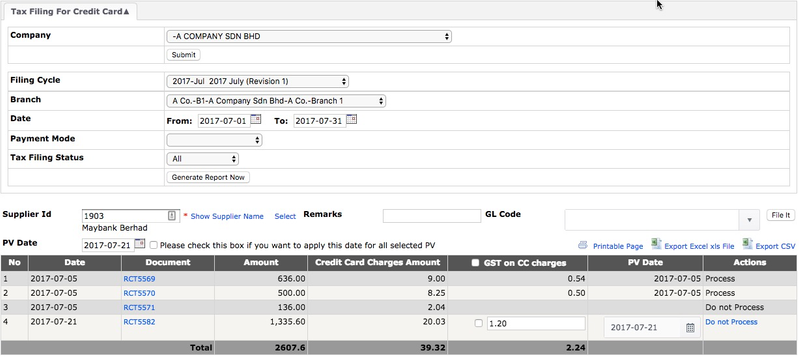

Tax Filing For Credit Card

Menu path: Extended Module > Malaysia GST > Tax Filling > Tax Filling For Credit Card

- Select Company and click Submit

- Select Filling Cycle → Date Range will auto generated base on filling cycle selected

- Select Branch

- Select Payment Mode → it refer to Credit Card Merchant and blank will generate ALL

- Select Tax Filling Status→ empty - not yet process ; All - select All ; Process - Input tax claimed ; Do not Process - marked as do not claim or claimed manually via gst adjustment

- Click Generate Report Now

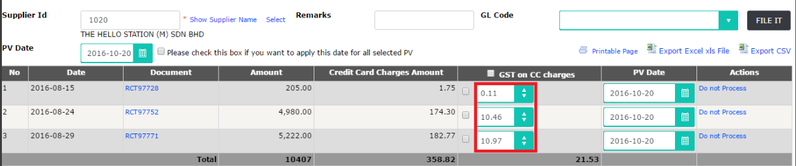

- Key in specific Supplier ID or click Select for search function → this refer to the Bank Payee

- Key in Remarks→ user may put Merchant Tax Invoice Reference No

- Key in GL Code→ recommended to use "GST_Contra" for the GL code and this GL Code is ised to record in Payment Voucher and GST Adjustment from this tax filling

- Change the PV date→ recommended to follow RCT date or credit card statement date

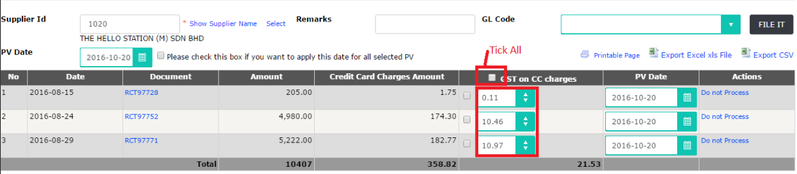

- Tick the "apply to all selected PV" → it will change ALL PV to follow the date

- Change the GST on CC Charges or tick ALL→ system DISPLAY the auto calculated the amount

- Change the PV Date → if user want the PV date to follow statement date

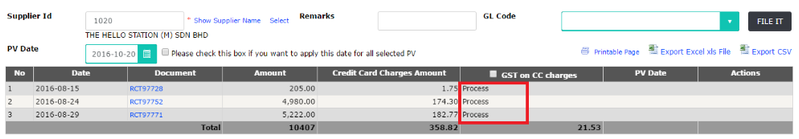

- Click File IT

- Status become "Process" and user may check atInput Tax Invoice Report

- GAF will updated include the Credit Card GST

- Click Printable Page, Export excel or Export CSV

Notes:

- System will show the process and do not process status when user generate ALL tax filling status

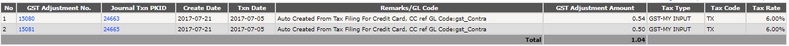

- JTxn adjustment will be created when filling is done

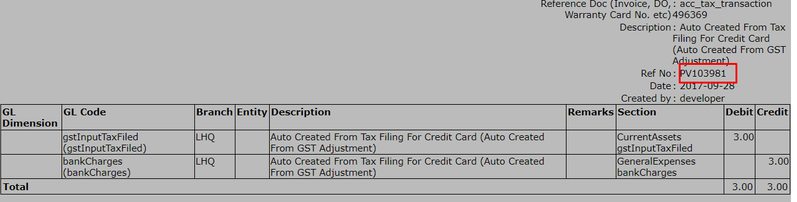

- The PV created for the RCT is shown under the Ref No section

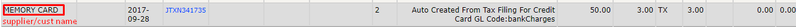

- The Business Reg Number, Supplier/Cust Name, and PV can see seen at Input Tax Invoice Report after the filling

Related Wiki Page:

Found 5 search result(s) for credit card.

Private & Confidential