Input Tax Filing

Menu Path: Extended Modules > Malaysia GST > Tax Filing > Input Tax Filling

Input Tax Filing is to file the input tax incurred in purchases and to claim it from Royal Custom.

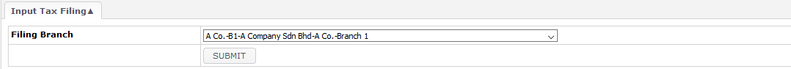

Generate filling cycles of specific branch :

- Click Submit upon selecting the specific Branch from the drop down menu, as shown in the image above

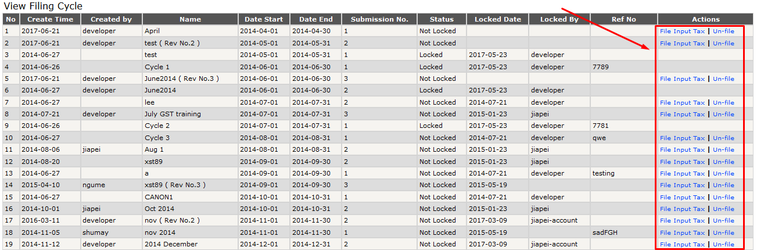

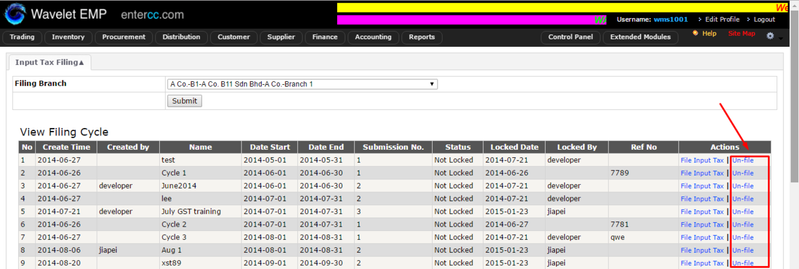

- Upon clicking on Submit, it will display all the filling cycle list

- Click on link labelled File Input Tax according to the related filling cycle

- Click on Un-File if any changes or amendments of filed transaction are required

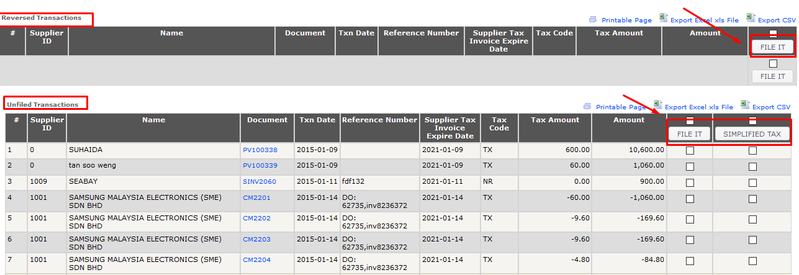

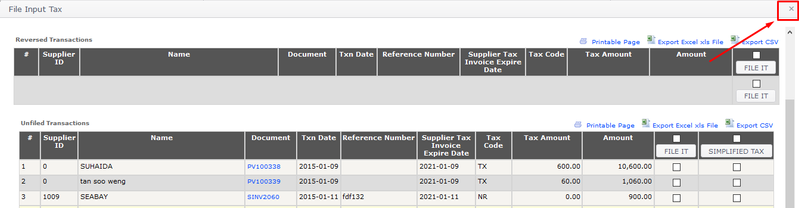

- Select transactions to be file in this filling cycle

- Reversed Transaction : filing of cancelled SINV / Supplier CM

- Click File It to confirm filling selected transaction

- If it is a simplified tax invoice, tick on Simplified Tax column to file it

- Click on the Cross on top right, to close the window upon completing filling up all required transaction.

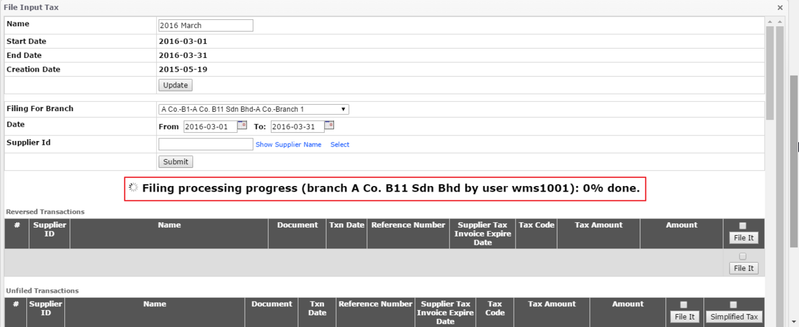

- The progress indicator has been added to show the process of filling that takes place

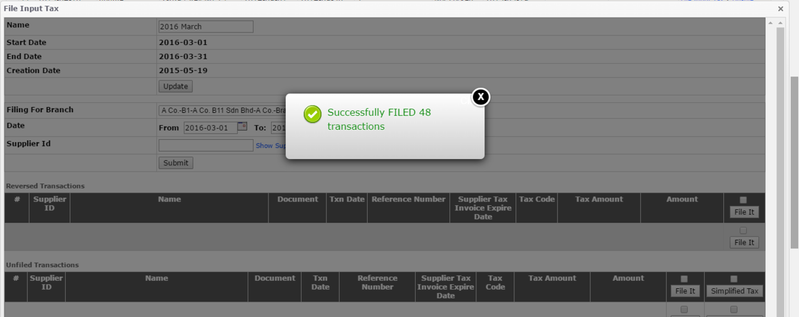

- A message will be displayed upon completing filling successfully.

- User can proceed to file more transactions if filling is incomplete.

- Red Sentence will notify the user when there is documents cannot be filed with its reason

Notes:

- Please contact Wavelet Support when there is Filling Failed

- Check the filed input tax in Input Tax Invoice Report

Q&A:

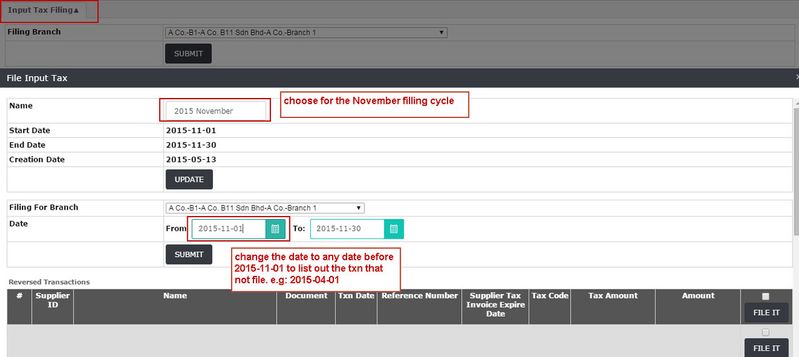

| Claim Input Tax for the transaction not within the taxable period |

|---|

Example: on 11 November 2015, create a back dated Supplier Invoice for rental expenses on 15 July 2015, the input tax amount want to claim on November 2015 taxable period

A: On November filling cycle month, the date From change to previous month date

Related Wiki Page:

Found 5 search result(s) for Tax Filling.

Private & Confidential