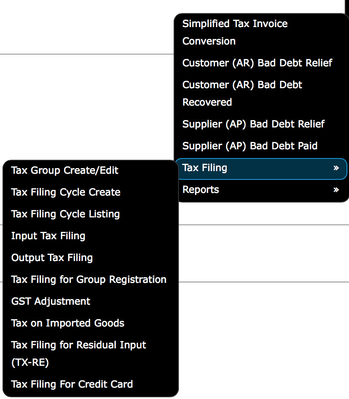

Tax Filing

Explanation

- All GST reporting, for example GAF File and GST Return Form, are generated base on Filing Cycles.

- In order to generate GAF File and GST Return Form, you will need to ensure that all GST transactions ( Sales, Purchase, Adjustments ) are filed into the correct Filing Cycle.

- Once a GST Return for a Filing Cycle is submitted to Royal Customs, it is advised to lock the filing cycle to avoid backdated transactions to be included in a Filing Cycle which is already submitted.

- In most cases, each month will have only 1 Filing Cycle. However, you can create more than 1 Filing Cycle for each month, provided all Filing Cycles for the said month has been LOCKED.

- This situation will arise if you left out any transactions, which is supposed to be filed into the previous Filing Cycle that has been LOCKED.

- Each Filing Cycle will automatically be tagged with a Submission No. The first Filing Cycle for the month will have Submission No 1, the next Filing Cycle for the same month will have Submission No 2 and so on.

Private & Confidential