Output Tax Filing

Menu Path: GO Extended Modules > Malaysia GST > Tax Filing > Output Tax Filing

| NOTE: Tax Invoice Report is required to submit before user can submit GST-03 Filling , Taxpayer Access Point(TAP) in RMCD website. |

|---|

Output Tax Filling

GST charged and collected on sales/supplies of goods and services to the customer

| Net GST to be paid to Government = Output Tax - Input Tax |

|---|

Steps and Descriptions:

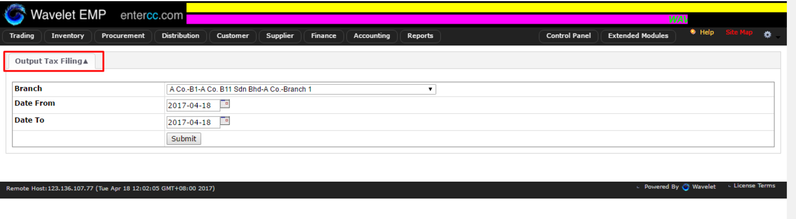

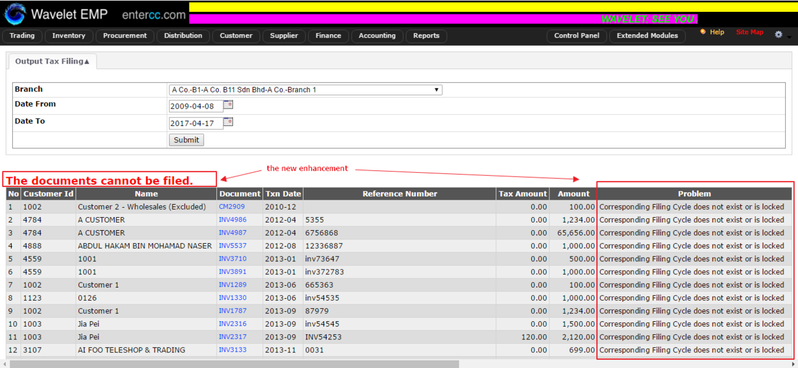

Unlike Input Tax Filing, user will not be able to choose which Output Tax transaction to file into which Filing Cycle. Instead, all Output Tax transactions will be filed into the Filing Cycle based on their transaction dates. In order to file the Output Tax, user just need to choose the Branch and Dates, then click Submit

- Choose the Branch from the drop down menu

- Date From and Date To

Click on Submit

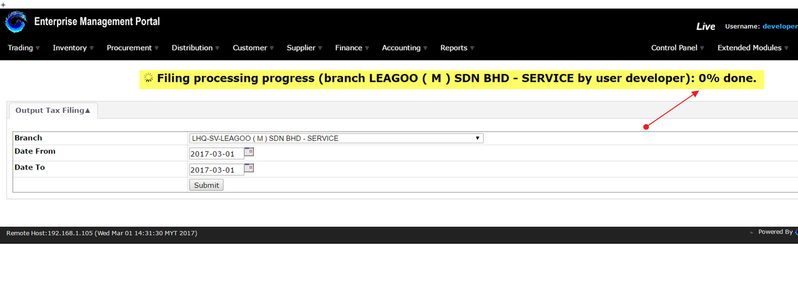

- The progress indicator will appears to show the progress of the filling i (percentage) to notify the user promptly

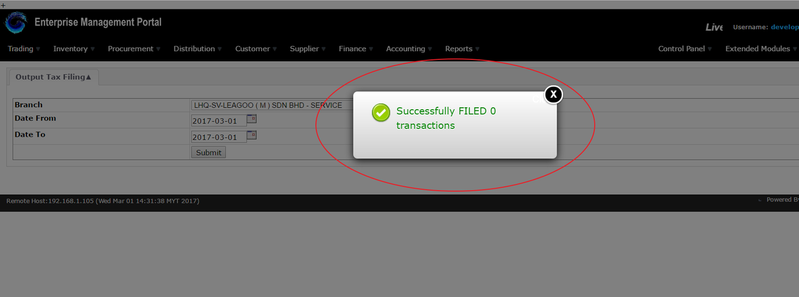

- Pop up will appear to show whether the filling process as been completed or done successfully

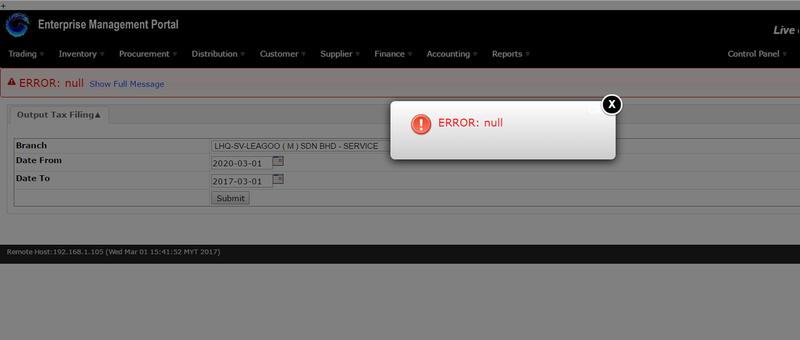

- Red Statement will notify user when there is documents which cannot be filled with its reason

NOTES:

- If there is "document cannot be filed" please contact wavelet support to report the problem

- Refer to GST-03 Info & Formula for which tax code will shown on the GST-03 and output input filling

Related WIKI Pages:

Found 5 search result(s) for Output Tax.

Private & Confidential