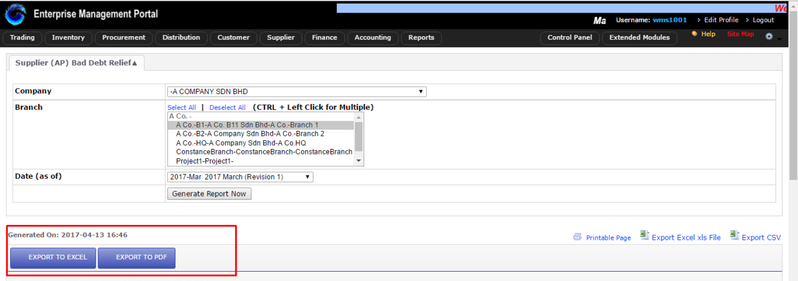

Supplier (AP) Bad Debt Relief

Menu Path: Extended Modules > Malaysia GST > Supplier (AP) Bad Debt Relief

Guide

1. Control Panel > System Admin > EMP Configurations > Tax > Sales (Output Tax) : assign a GL Code as Default GL Code for AP Bad Debt Relief ( Refer to GST Setup User Guide (2015-04-01), 3.2: Sales (Output Tax)

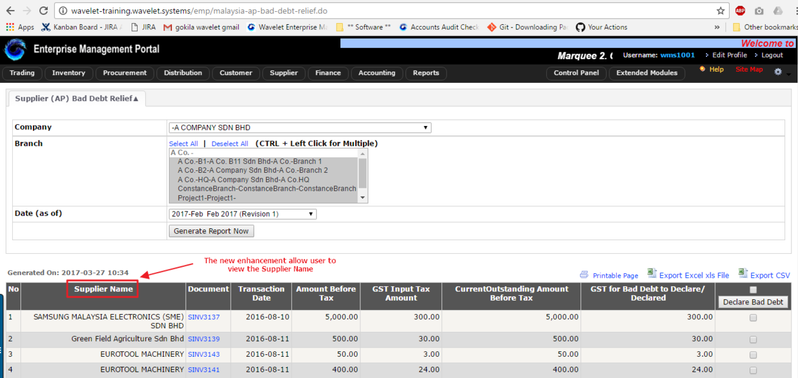

Supplier Name Column:

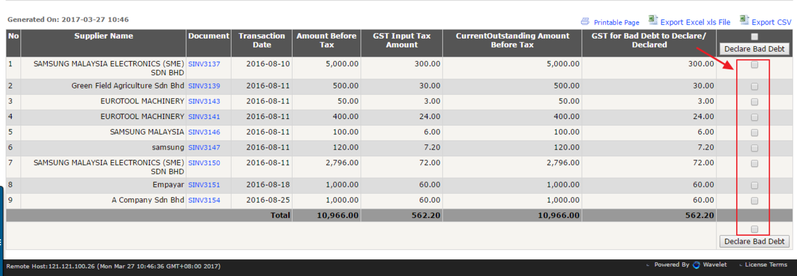

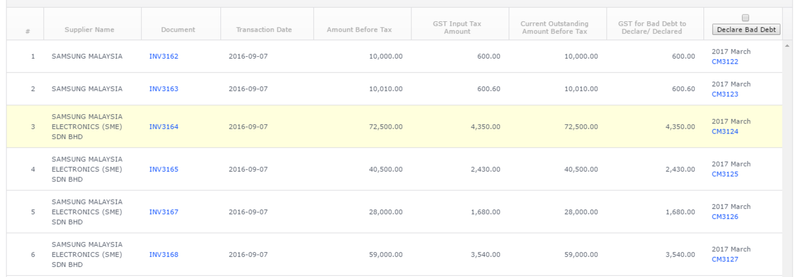

Date (as of) : Select the 2017 Feb filling cycle, system will list out the 2017 Feb outstanding documents. Select the Supplier Invoice to declare Bad Debt,

then click "Declare Bad Debt" .

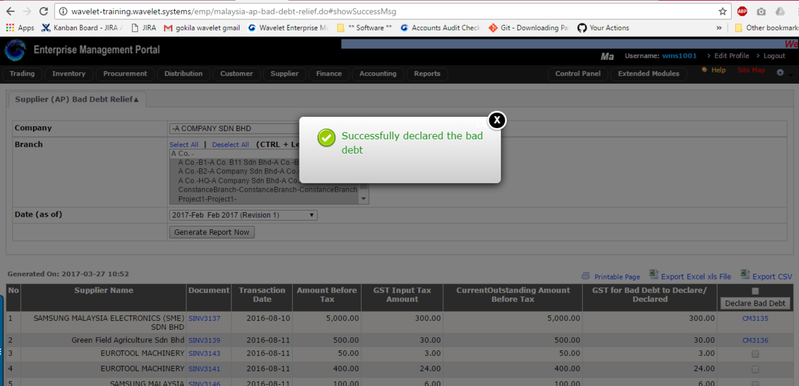

After the user selected the Supplier Invoice for reporting Bad Debt Relief, if it is successful, then the screen will display the output screen

" Successfully Reported ".

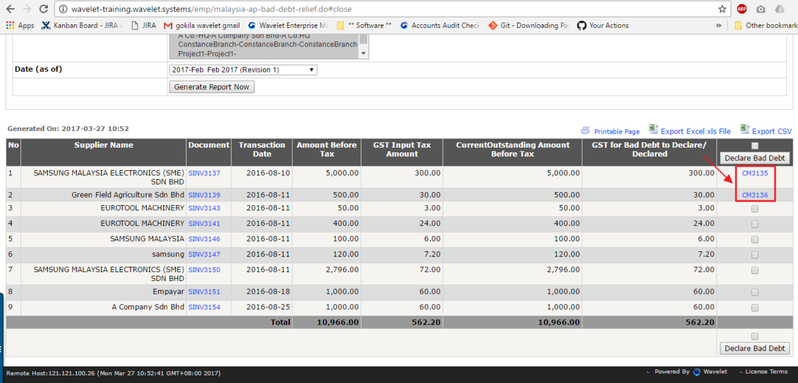

After user have successfully reported, the system will automatically generate the CM where user will be able to find on the right

side of the system, under the "Declare bad debt" column.

- Upon clicking "Declare Bad Debt", a Credit Memo will be automatically created to record the bad debt.

- System will prevent if there are teo / more user click to create the same CM at the same time

- Proceed with the Input Tax Filling Step (Input Tax Filing)

- The CM recorded in Output Tax Invoice Report, tax code: AJS (Output Tax Invoice Report)

- GST-03 Report, on 5b Total Output Tax (Inclusive of Bad Debt Recovered & other Adjustments)

Detail explanation on the listing above

Document | Supplier Invoices that have outstanding amount 6 months after being issued |

Amount Before Tax | Supplier Invoice total amount before tax |

GST Input Tax Amount | Tax amount for the Supplier Invoice |

Current Outstanding Amount Before Tax | Supplier Invoice current outstanding amount before tax |

GST for Bad Debt to Declare/Declared | Tax amount for the outstanding amount |

Plugin:

- Job Main Class : taskscheduler.baddebt.ap_baddebt_relief.src.APbadDebtRelief

- Job Parameters :-

- Name : TO Value : valid email

- Name: company_code Value : company name

- Name: filling_cycle_name-Value:

- Name: filing_cycle_date_start Value : 2016-03-01

- the plug-in will email a list of ALL CM created and instruct to file them

- cannot run the plug-in without entering a valid email parameter

Enhancement: Kendo UI Report Format

- The image above shows the new enhancement made on the format.

- This format needs to be enabled at the Control Panel > System Admin > EMP Configurations > System

- The feature allows the report to be generated in the Kendo UI Format, that is available under the Supplier (AP) Bad Debt Relief function, on EMP

- The image above shows on how the report result looks like when was generated in a Kendo UI Format

Related WIKI Pages:

Found 5 search result(s) for Bad Debt.

Private & Confidential