Method A

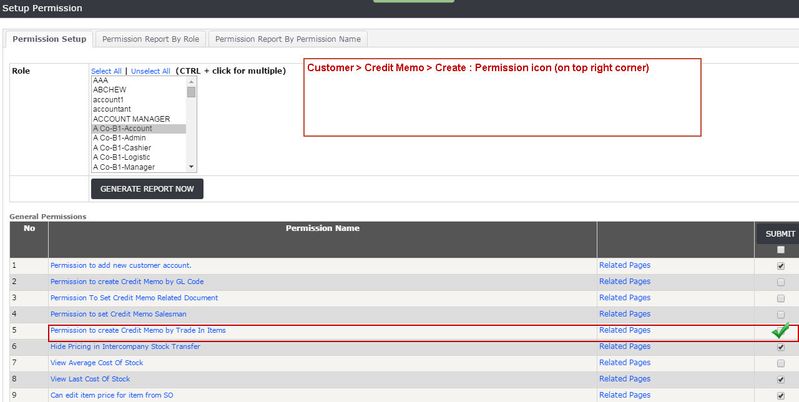

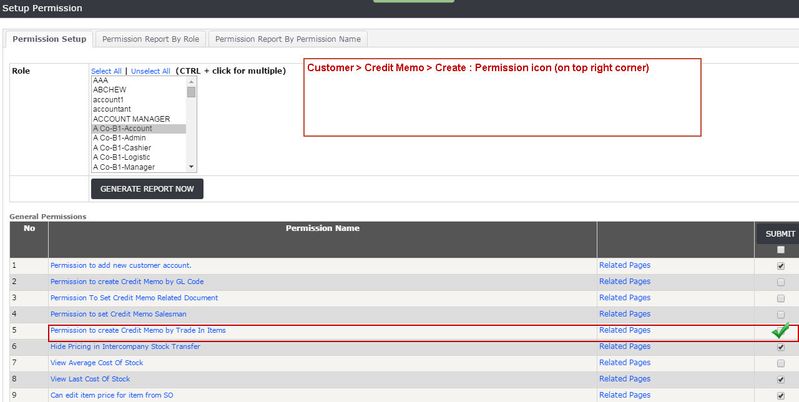

Step 1:

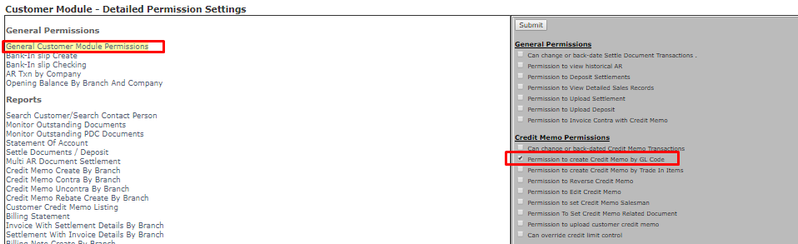

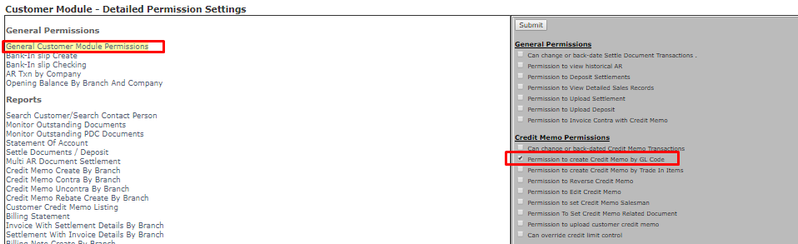

Menu Path: Control Panel > System Admin > Manage User > Configure Role Permission > Customer > General Customer Module Permissions > Permission to create Credit Memo by Trade In Items

- Tick to allow create Trade In

- Untick to disallow create Trade In

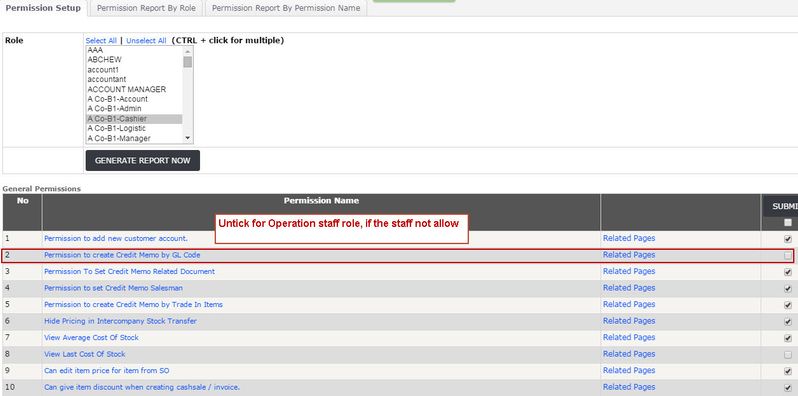

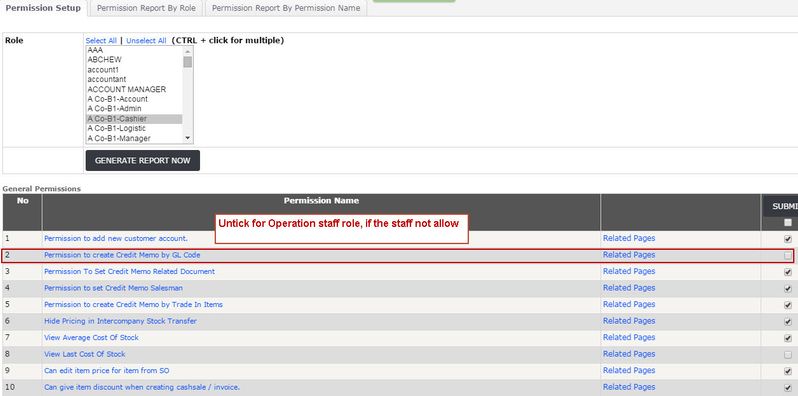

Step 2:

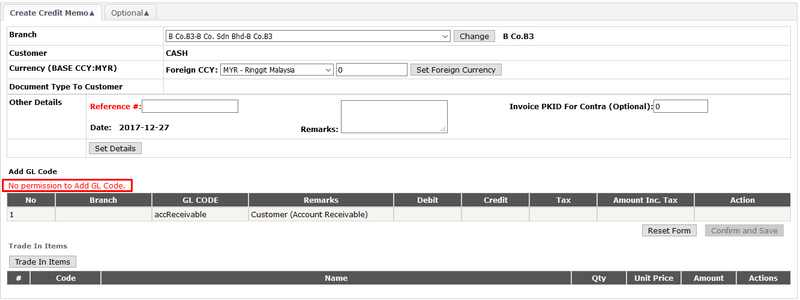

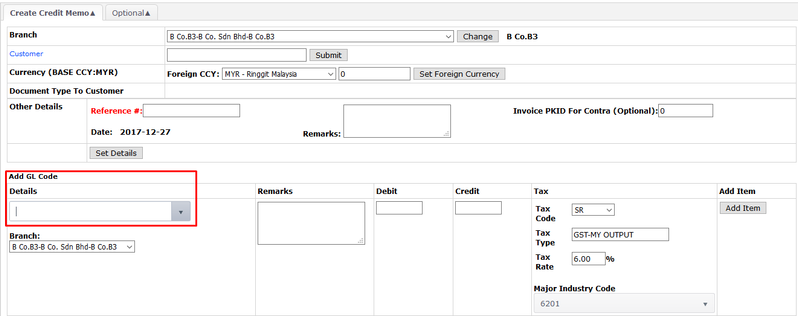

Menu Path: Control Panel > System Admin > Manage User > Configure Role Permission > Customer > General Customer Module Permissions > Permission to create Credit Memo by GL Code

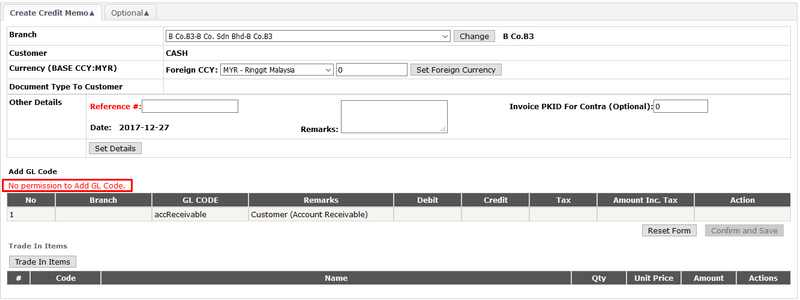

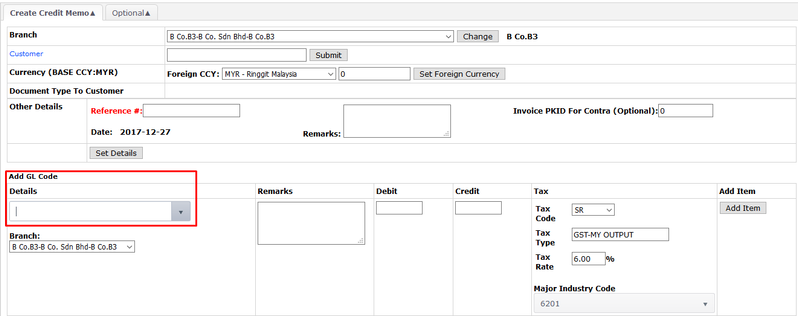

- Untick to disable the GLcode part on Trade In Page or allow create Manual Customer Credit Memo → apply for operation staff who cannot see the accounting part

- Tick to enable the GLcode part on Trade In Page or allow create Manual Customer Credit Memo

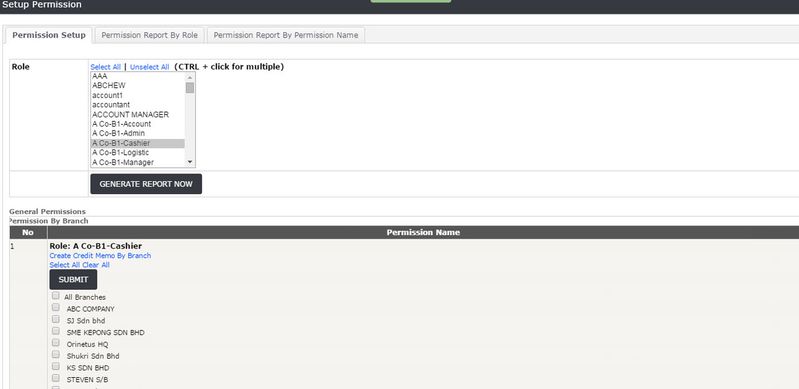

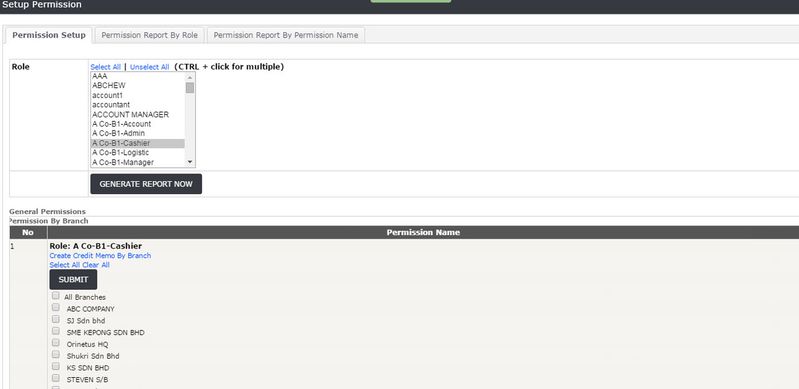

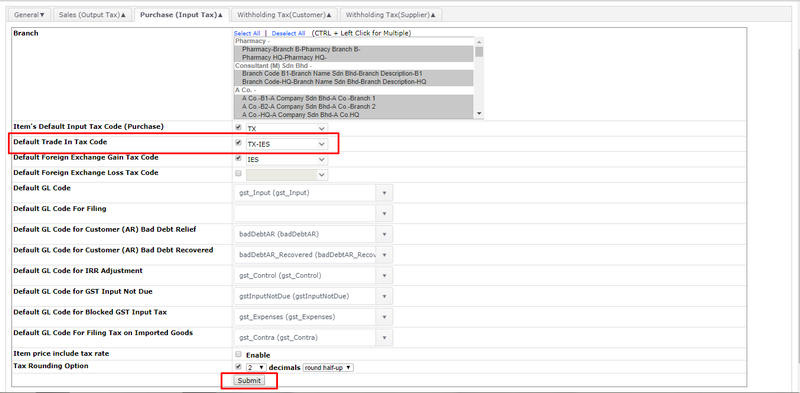

Step 3:

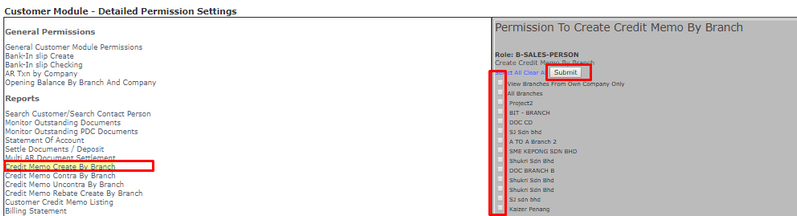

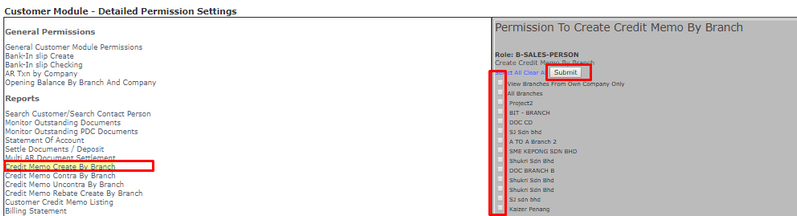

Menu Path: Control Panel > System Admin > Manage User > Configure Role Permission > Customer > Credit Memo by Branch

- Untick Location to disallow

- Tick Location to allow

- Click Submit

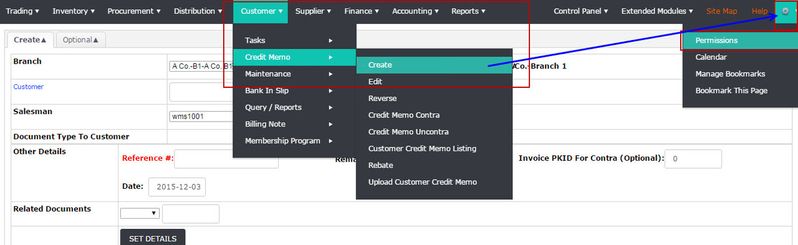

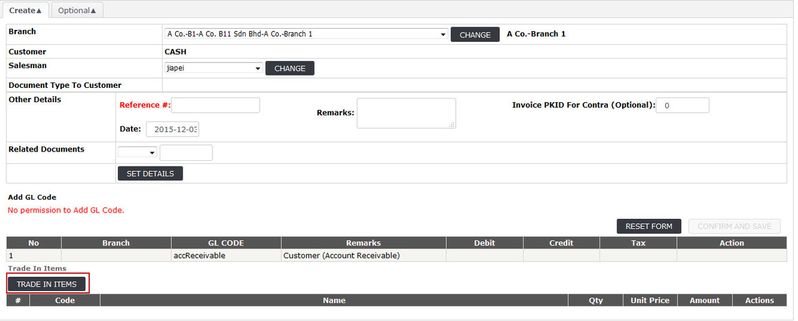

Method B

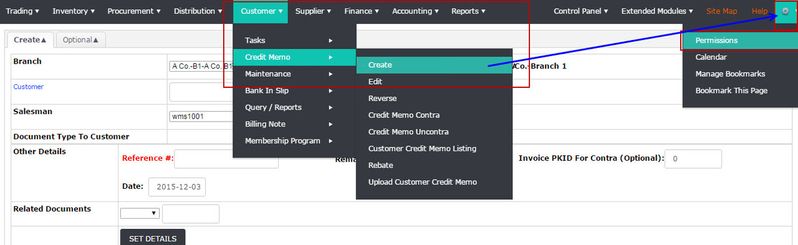

Menu Path: Customer > Credit Memo > Create > Permission icon on top right corner