EMP Configuration - Tax

Menu Path: Control Panel > EMP Configurations > Tax

General Tab

- Choose Tax Country

- Choose the Goods and Service Tax Abbreviation

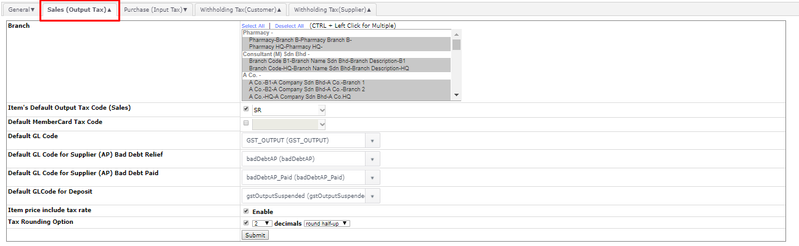

Sales (Output Tax)

- This configuration effects Sales related transactions for example: Invoice, Cashsale, Sales Return etc.

- Select the Branch which subject to Output Tax or implement Tax

- Select Default Item Tax Code, Default Tax Codes → for sales

- Tick to Enable Inclusive on Item Price → Recommendation: Retailer used INCLUSIVE TAX method

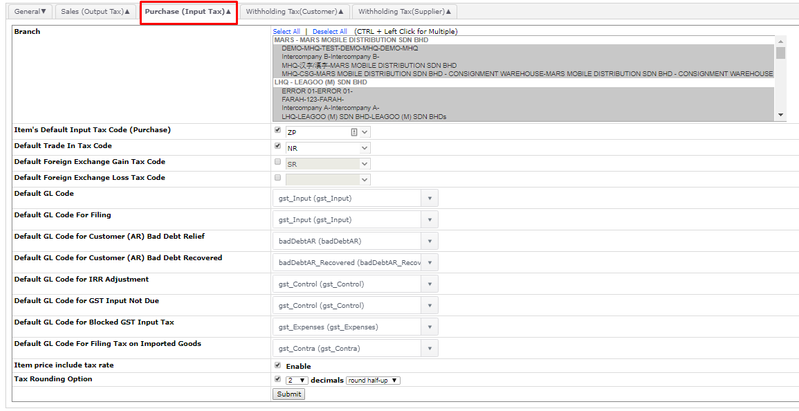

Purchase (Input Tax)

- This configuration effects Purchase related transactions for example: GRN, Credit Memo, Purchase Return etc.

- Select the Branch which subject to Input Tax or implement Tax

- Select Default Item Tax Code, Default Tax Codes → for purchase

- Tick to Enable Inclusive on Item Price → Recommendation: Retailer used EXCLUSIVE TAX method

- Default GL for Forex Gain or Loss can be configured → automate the Currency

The picture above shows the correct default GL Code for each function.

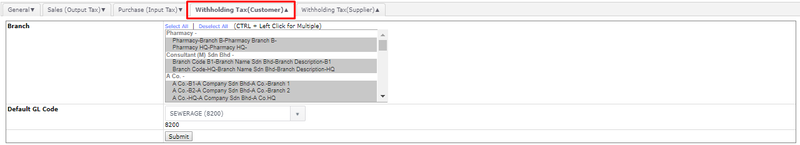

Withholding Tax (Customer)

- Used for Thailand → refer to the tax withhold by customer during the payment (Receipt function)

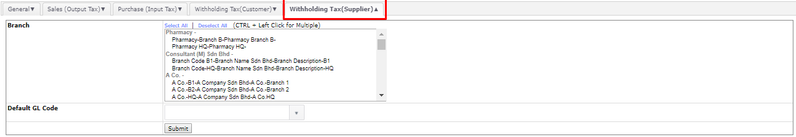

Withholding Tax (Supplier)

- Used for Thailand → refer to the tax withhold by suppluer during the payment (Payment Voucher)

| Tab | Field | Description | Recommended Value |

| General | Tax Country | This will determine how GST is processed and reported. Also, by setting this, all tax codes defined by Royal Customs will be activated automatically | MALAYSIA |

| Goods and Service Tax Abbreviation | This is for labelling. Default value is “Tax” | GST | |

| Sales (Output Tax) | Branch | Normally, if a company is subjected to GST, all its branches will be subjected to GST, except those in Tax Free Zone. | All branches subjected to GST. |

| Item’s Default Output Tax Code (Sales) | When this is enabled, when adding new item from Inventory > Item > Add Item, default values : Tax Option = Tax Applicable, Input Tax Code = the chosen GST Code | SR | |

| Default GL Code | This GL Code will be used to record all Output GST during sales transactions. Ensure this GL Code has already been added into the system first. | gst_Output | |

| Default GL Code for Bad Debt Relief | When a Supplier Invoice is declared as bad debt, it will increase the Output Tax. For more information, refer to Supplier (AP) Bad Debt Relief | badDebtAP | |

| Default GL Code for Bad Debt Paid | When a Supplier Invoice is declared as bad debt but later on paid, it will increase Input Tax. For more information, refer to Supplier (AP) Bad Debt Paid | badDebtAP_Paid | |

| Default GL Code for Deposit | This GL Code will be used to record the deposit’s GST. For more information, refer to Deposit from Customer | gst_Output_Suspended | |

| Item price include tax rate | By default, item’s selling price is excluding GST. Enable this if the amount keyed in by cashier is inclusive of tax amount. Example : Item Selling Price = Rm100, GST = 6%, Qty sold = 1 If this Option is Disabled, Invoice will show : Sub Total = Rm100, GST = Rm 6, Grand Total : Rm106. If this Option is Enabled, Invoice will show : Grand Total = Rm100, GST : Rm6 | ||

| Tax Rounding Option | Decides how the GST amount should be rounded. Round half-up : 0.001 - 0.004 round to 0.00, 0.005 - 0.009 round to 0.01. Round up : 0.001 - 0.004 round to 0.01, 0.005 - 0.009 round to 0.01 | 2 decimals, round half-up | |

| Purchase (Input Tax) | Branch | Normally, if a company is subjected to GST, all its branches will be subjected to GST, except those in Tax Free Zone. | All branches subjected to GST. |

| Item’s Default Output Tax Code (Sales) | When this is enabled, items added to PO / GRN will by default, follow the GST Code configured | TX | |

| Default GL Code | This GL Code will be used to record all Input GST during purchase transactions. Ensure this GL Code has already been added into the system first. | gst_Input | |

| Default Trade In Tax Code | |||

| Default Foreign Exchange Gain Tax Code | IES | ||

| Default Foreign Exchange Loss Tax Code | OS | ||

| Default GL Code for filing | This does not need to be set for Malaysia GST at the moment. | <blank> | |

| Default GL Code for AR Bad Debt Relief | When a Customer Invoice is declared as bad debt, it will increase the Input Tax. For more information, refer to Customer (AR) Bad Debt Relief | badDebtAR | |

| Default GL Code for AR Bad Debt Recovered | When a Customer Invoice is declared as bad debt but cleared later, it will increase the Output Tax. For more information, refer to Customer (AR) Bad Debt Recovered | badDebtAR_Recovered | |

| Default GL Code for IRR Adjustment (Advance only) | This GL Code will be used to record GST amount for IRR Adjustment. For more information, refer to Partial Exemption (IRR) | gst_Control | |

| Default GL Code for GST Input Not Due | |||

| Default GL Code for Blocked GST Input Tax | This GL Code will be used for unclaimable Input Tax which will be expenses for the company | gst_Expenses | |

| Default GL Code For Filing Tax on Imported Goods | This GL Code will be used for Default Foreign Exchange Gain / Loss Tax Code | gst_Contra | |

| Item price include tax rate | By default, item’s purchase price is excluding GST. Enable this if the amount keyed in by procurement staff is inclusive of tax amount. Example : Item purchase Price = Rm100, GST = 6%, Qty sold = 1. If this Option is Disabled, GRN will show : Sub Total Rm100, GST Rm 6, Grand Total Rm106. If this Option is Enabled, GRN will show : Grand Total Rm100, GST Rm 6 | ||

| Tax Rounding Option | Decides how the GST amount should be rounded. Round half-up : 0.001 - 0.004 round to 0.00, 0.005 - 0.009 round to 0.01. Round up : 0.001 - 0.004 round to 0.01, 0.005 - 0.009 round to 0.01 | 2 decimals, round half-up | |

| Withholding Tax (Customer) | Not applicable to Malaysia | ||

| Withholding Tax (Supplier) | Not applicable to Malaysia |

NOTES:

- Make sure tax code IES tax code is deactivated (IF NOT used at any default setting) when tax country is changed from Malaysia to any other country

- An error will shown if the IES tax code is set as default and user tried to change from Malaysia to another country

Found 5 search result(s) for Tax.

Private & Confidential