Filing for 'cancelled' Supplier Invoice

Q : Can I file a manual Supplier Invoice after canceling it?

A: Yes.

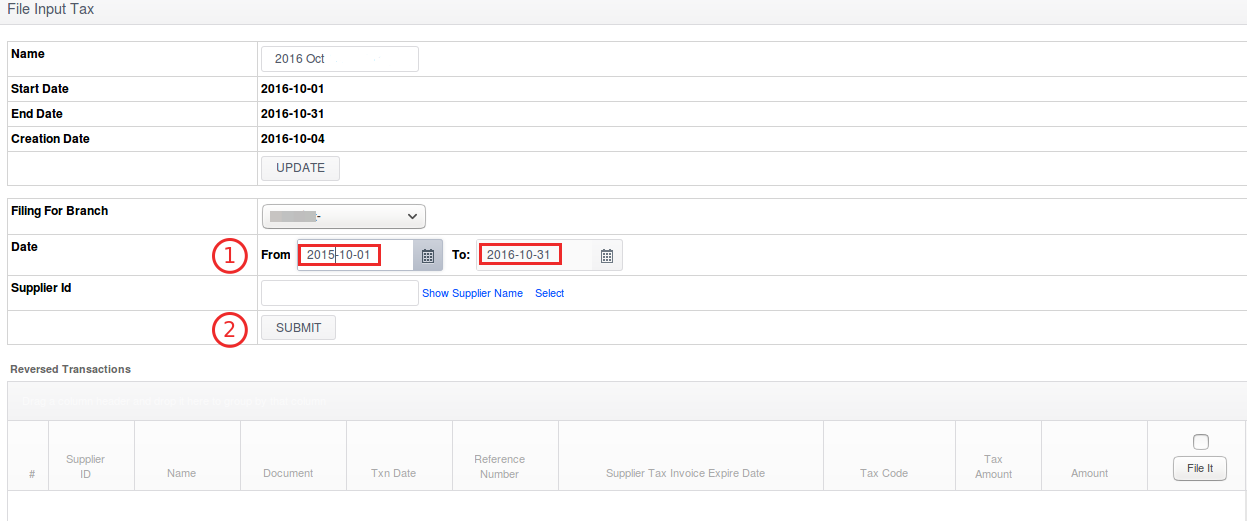

If you have canceled (Supplier > Supplier Invoice > Cancel1.) a manual Supplier Invoice after it's GST filing2., you are required to file it again. The 'cancelled' Supplier Invoice can be filed for reporting to GST-03 for up to 6 years. If you cannot find the SINV in the list, please try modifying the search dates.

e.g. Malaysia GST > Tax Filing > Input Tax Filing

The canceled SINV will list under the 'Reversed Transactions' section.

Notes:

- Note, that this was previously allowed by the system. As of November 2016, this function does not allow cancellation of SINV that have been filed for GST. In the near future, this feature may be available again.

- Note, if the manual SINV has not been filed for GST before, it is not required to be filed after being canceled.

Private & Confidential