Transaction for Imported Goods

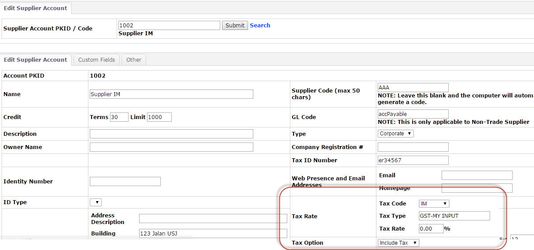

- Supplier Maintenance > Tax Rate: IM 0%

Supplier > Maintenance > Create Supplier or Edit Supplier - Received Stock from Oversea Supplier

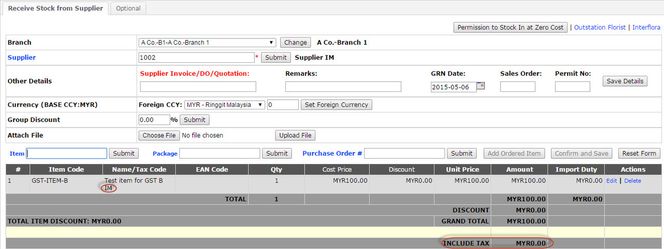

Procurement > Transaction > Direct Receiving Stock - Record forwarder bill

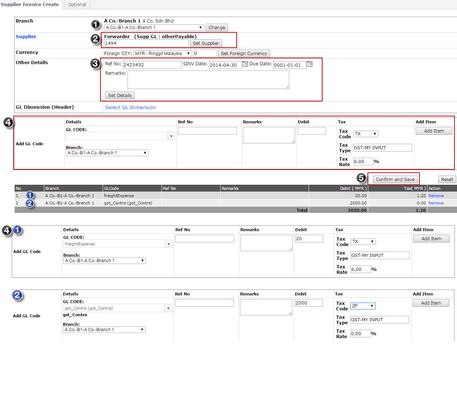

Suppler > Supplier Invoice > Supplier Invoice Create - Payment to Supplier and forwarder

Finance > Payment Voucher > Create - Claim for Input Tax for Imported Goods

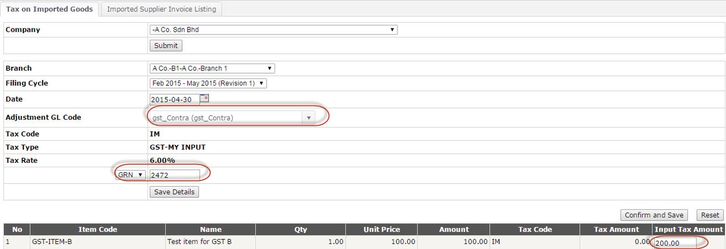

Tax on Imported Goods

Extended Module > Malaysia GST > Imported Goods filling

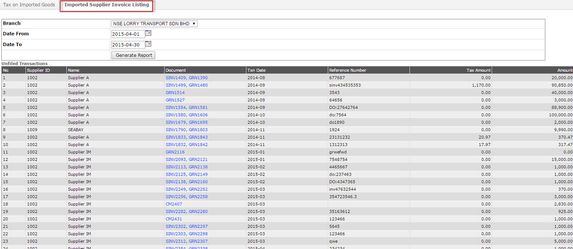

6. To check the GRN / SINV transaction for IM code

Extended Module > Malaysia GST > Imported Goods filling > Refer Tab : Imported Supplier Invoice Listing

Private & Confidential