How to adjust the GST Input Tax code? Should be NR but record as TX

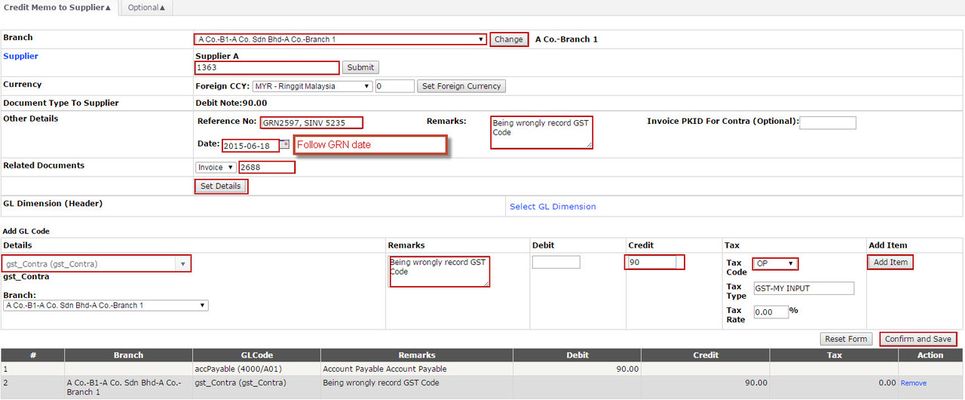

- Need to issue the Supplier Debit Note to reduce the outstanding amount (extra GST amount)

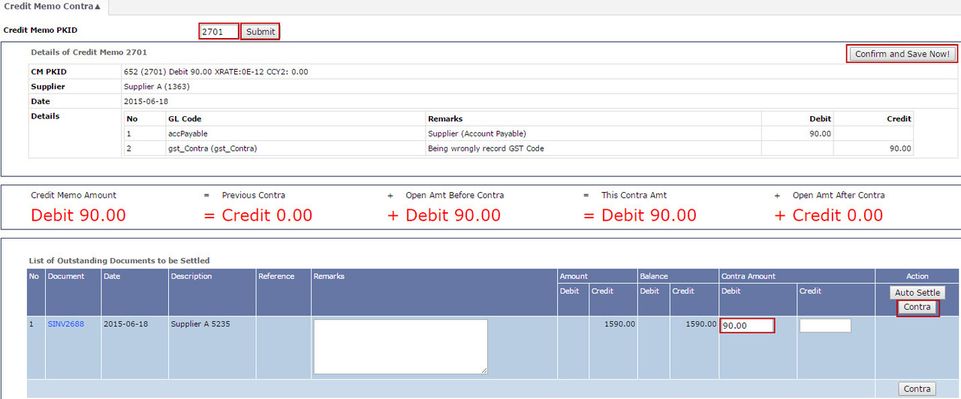

Menu Path: Supplier > Credit Memo > Create - To reduce the Input Tax Claim

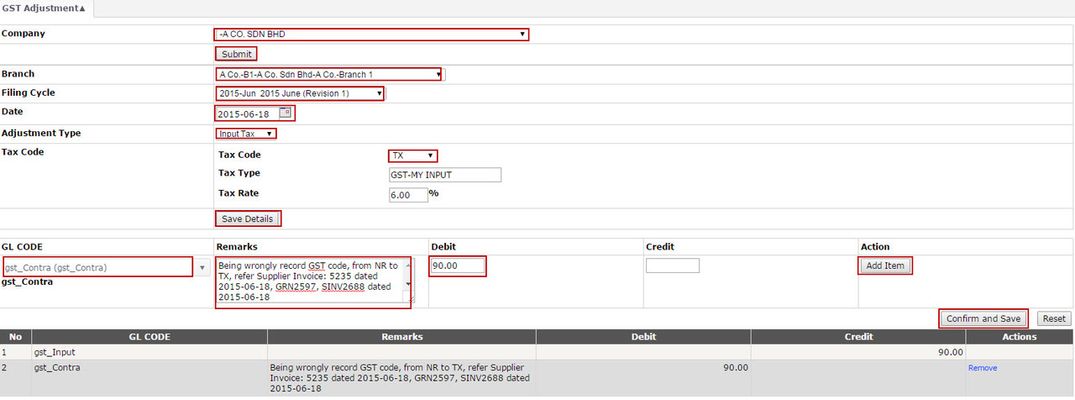

Menu Path: Extended Module > Malaysia GST > Tax Filing > GST Adjustment - File Input Tax

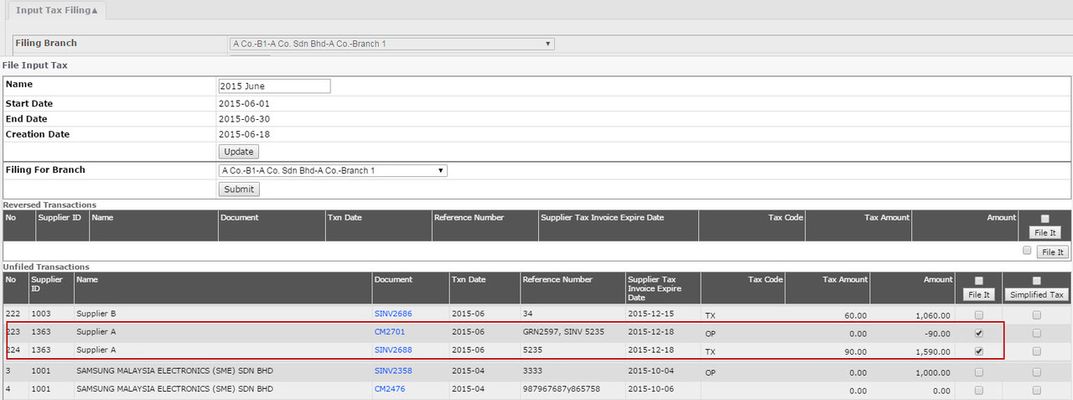

Menu Path: Extended Module > Malaysia GST > Tax Filing > Input Tax Filing - Result: Input Tax Invoice Report

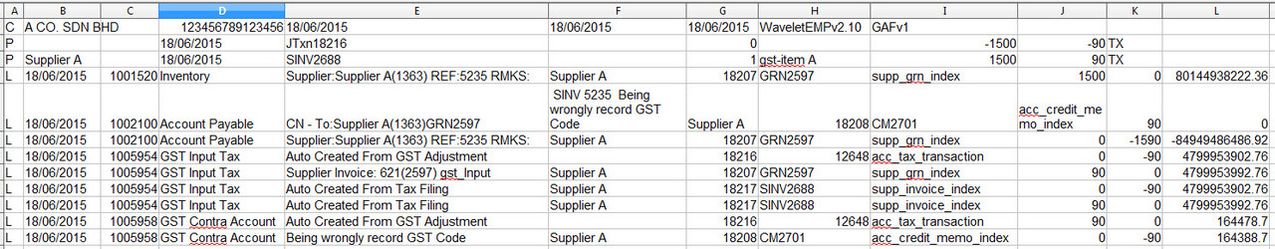

Menu Path: Extended Module > Malaysia GST > Report > Input Tax Invoice Report - Result : GST Audit report

Menu Path: Extended Module > Malaysia GST > Report > GST Audit File - Result: Journal Entry

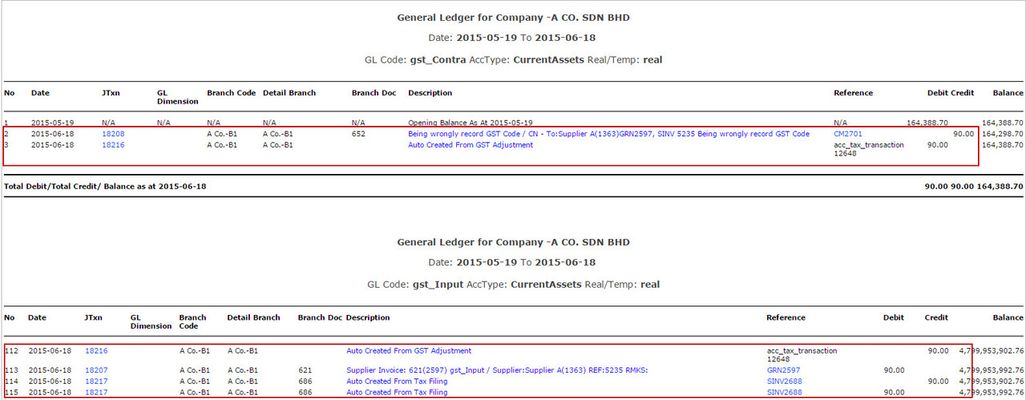

Menu Path: Accounting > Journal and Ledger ? GL Listing - Contra the Supplier Debit Note with Supplier Invoice

Menu Path: Supplier > Credit Memo > Credit Memo contra - Payment to Supplier

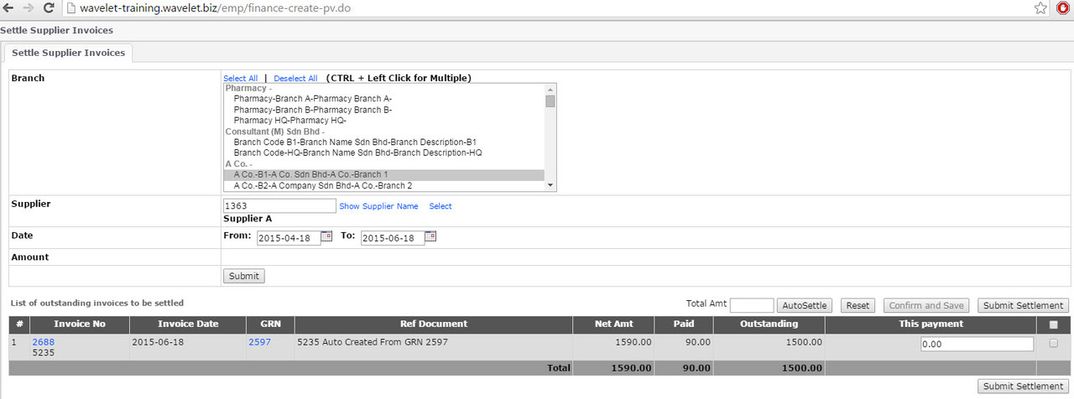

Menu Path: Finance > Payment Voucher > Create - Supplier Ledger

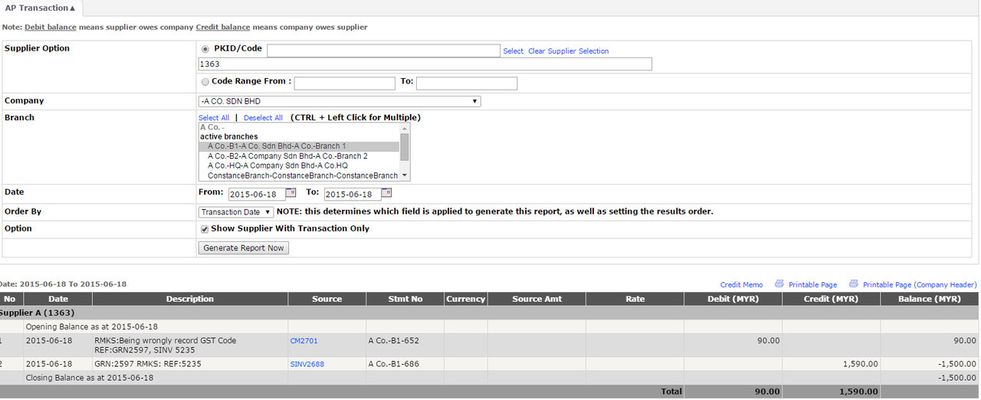

Menu Path: Supplier > Creditor > AP Transaction

Private & Confidential