Rounding Adjustment in GST Input Tax

This guide is SOP to correct tax calculation variance in supplier invoice (Created from GRN)

Example:

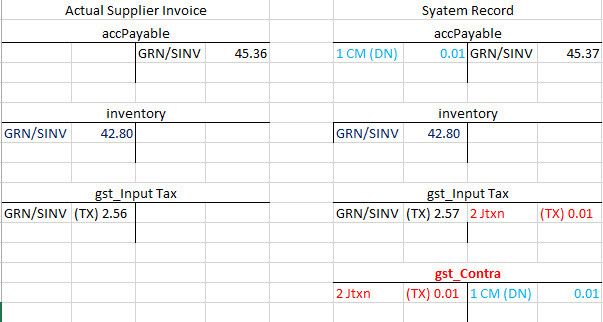

| Actual Supplier Invoice | Amount RM | System: GRN Supplier Invoice | Amount RM | |

|---|---|---|---|---|

| Unit Price | 42.80 | Unit Price | 42.80 | |

| GST @ 6% | 2.56 | GST @ 6% | 2.57 | |

| Total | 45.36 | Total | 45.37 |

Refer to above sample transaction, supplier account over record of RM 0.01 and GST input tax record extra RM 0.01

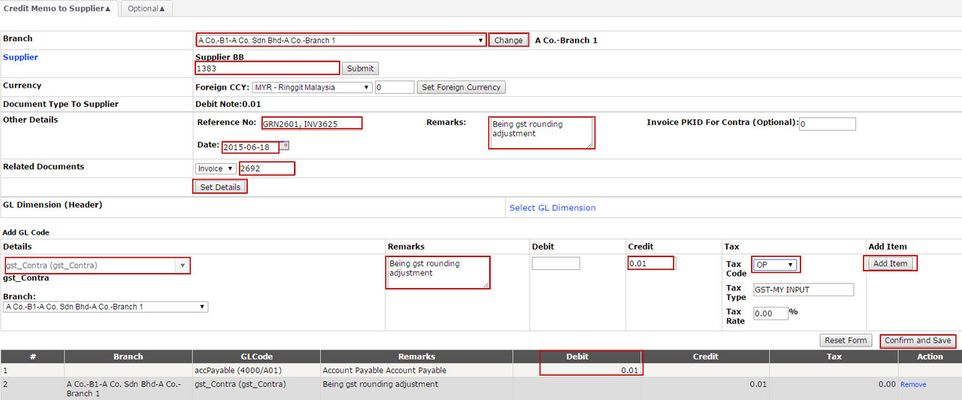

1) Create the supplier Debit Note to reduce the total amount in accPayable account

Menu Path: Supplier > Credit Memo > Create

i) gst_Contra in credit amount (Reduce to accPaybale account, Supplier Debit Note created)

ii) gst_Contra in debit amount (Increase to accPayable account, Supplier Credit Note created)

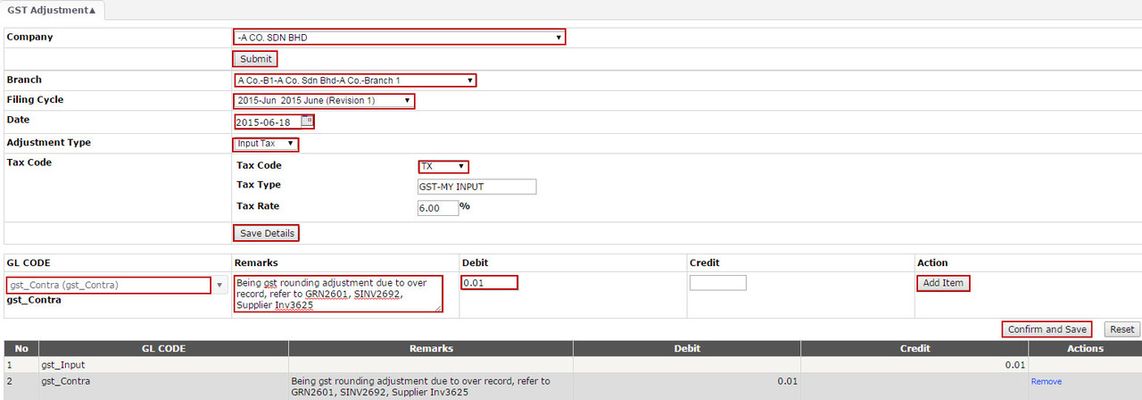

2) To reduce the Input Tax Claim

Menu Path: Extended Module > Malaysia GST > Tax Filing > GST Adjustment

i) gstContra in debit amount (if step 1, Supplier Debit Note created)

ii) gstContra in credit amount (if step 1, Supplier Credit Note created)

3) Contra the Supplier Credit Memo to the related Supplier Invoice

Menu Path: Supplier > Credit Memo > Credit Memo contra

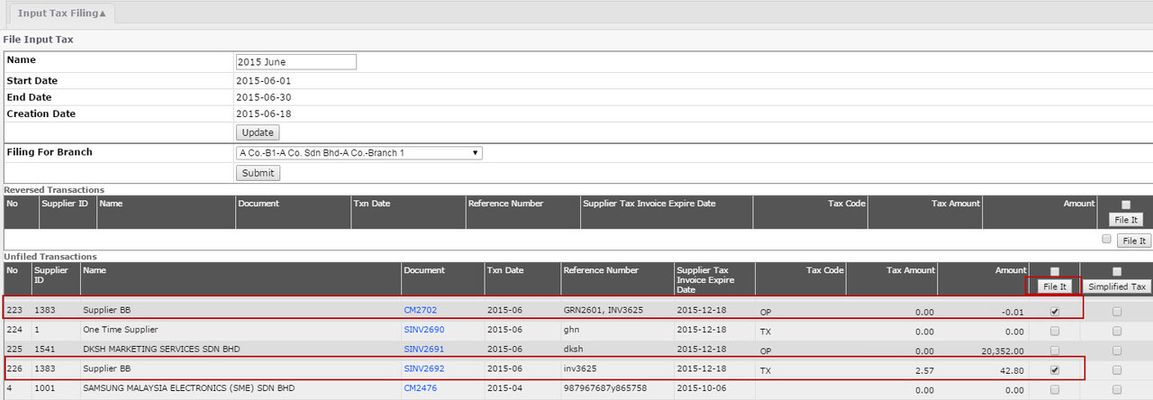

4) File Input Tax

Menu Path: Extended Module > Malaysia GST > Tax Filing > Input Tax Filing

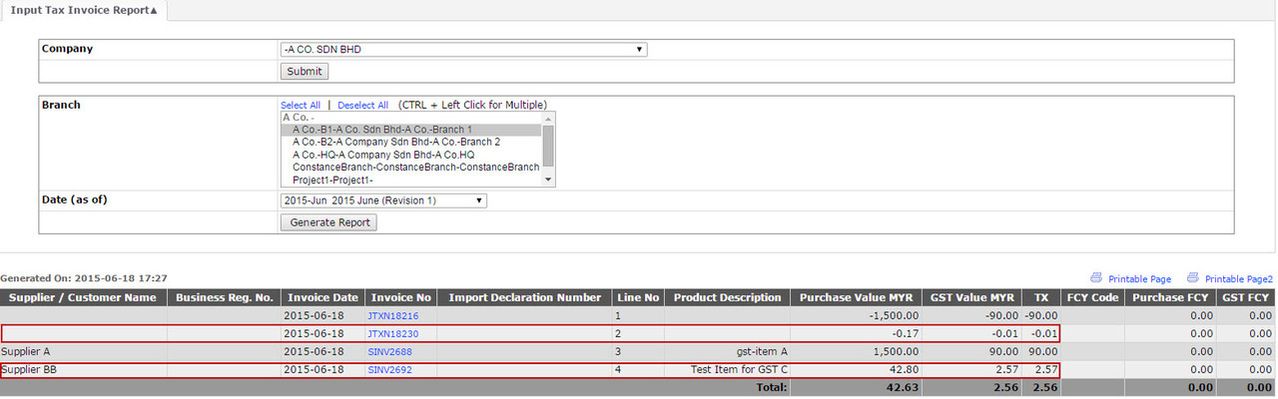

5) Result: Input Tax Invoice Report

Menu Path: Extended Module > Malaysia GST > Report > Input Tax Invoice Report

Related:

How to adjust the GST Input Tax code? Should be NR but record as TX

Private & Confidential