Difference between reimbursement and disbursement

Bottomline

Disbursement = No GST, Reimbursement = levy GST.

Reimbursement

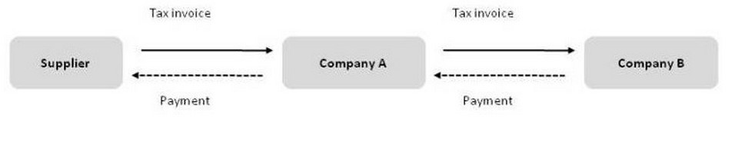

The following diagram illustrates a typical reimbursement scenario:

Supplier issues a tax invoice to company A.

Company A is legally responsible to pay supplier for the goods and services.

Company A re-bills company B for the goods and services

GST must be charged as it is viewed as a separate supply for GST purposes. This is commonly known as a reimbursement.

Disbursement

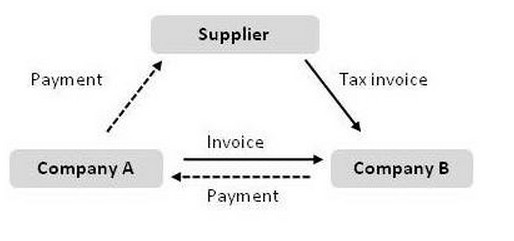

The following diagram illustrates a typical disbursement scenario:

Supplier issues a tax invoice to company B.

Company B is legally responsible to pay supplier for the goods and services.

Company A is merely paying on behalf of company B.

When Company A recovers this sum of money from company B, it can be treated as a disbursement, assuming all the conditions for disbursement are met.

Conditions for disbursements

Situation: You make payment on behalf of another party where supplier bills the other party.

The other party is responsible for paying the supplier;

The other party knows that the goods or services would be provided by that supplier;

The other party authorised you to make the payment on his behalf;

The other party is the recipient of the goods or services;

The payment is separately itemised when you invoice the other party;

You recover only the exact amount paid to the supplier; and

The goods or services paid for are clearly additional to the supplies you make to the other party.

If all the above conditions are met, this transaction is treated as a disbursement and no GST is chargeable. For disbursements, you cannot claim the input tax incurred for the original supply.

Some common disbursement examples:

A freight forwarding company makes payment for import duty and GST to Singapore Customs on behalf of their clients who are the owners of the imported goods. When the company re-bills the client for this payment, there is no GST chargeable.

A motor trader pays the insurance premium on the customer's behalf. When the motor trader re-bills the customer for the premium, there is no GST chargeable.

Private & Confidential