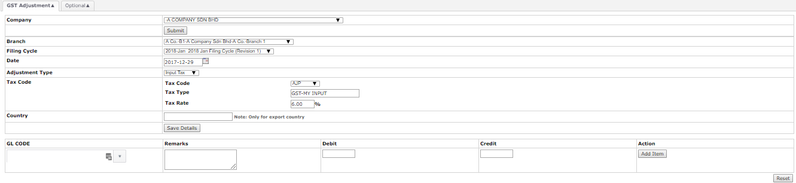

Menu Path: Extended Modules > Malaysia GST > Tax Filing > GST Adjustment

- Select Company and Click Submit

- Select Branch

- Select Filling Cycle → refer to Tax Filling Cycle Listing

- Select Date

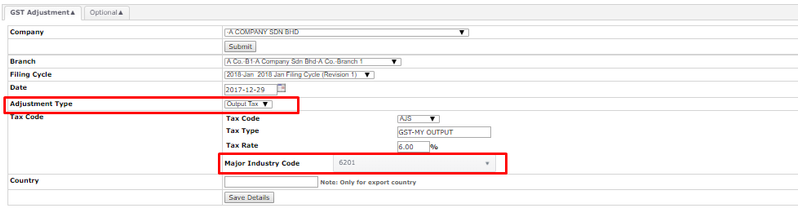

- Select Adjustment Type → input or output tax

- Select Tax Code → refer for the adjustment tax code

- Key in Country → only for export country

- Click Save Details

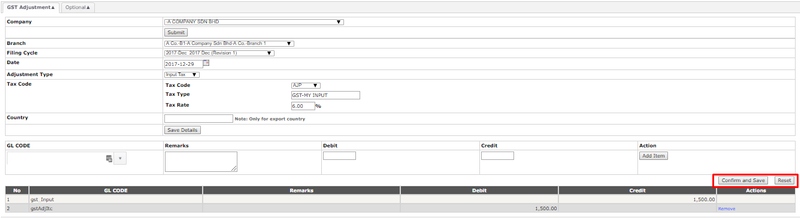

- Key in GL Code, Remarks, Debit or Credit

- Click Add Item

- Click Confirm and Save → to proceed create the GST adjustment

- Click Reset → to refresh the whole page

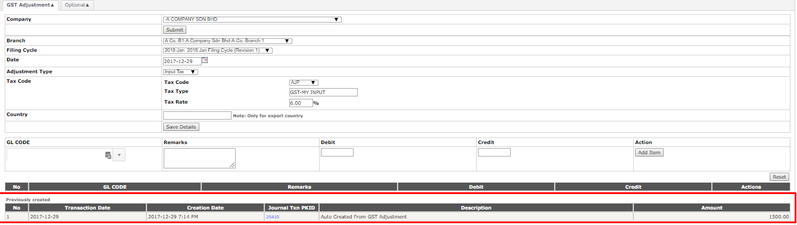

- The Journal Txn will be created and shown as 'previously created' transaction

NOTES:

- MISC Code (Major Industry in Sales Code) need to be selected if the 'Adjustment Type' is OUTPUT TAX

Related Wiki Pages:

Found 5 search result(s) for GST Adjustment.