SST Implementation

Note: Please be notified that this is Proposed guide only, any updates will be referred to Customs - SST

- Customs will be sending email to the GST registered company, in case they have been automatically registered for SST.

- In case the company has not received any email for Customs which notifying on the SST auto-registration, company needs to check from the following link, whether their company is registered under SST:

Customs - SST Registration Status - Please be notified that for SST, Sales Tax and Service Tax are separate Tax Acts.

- Please refer to the following link for SST- List of Taxable Goods

- Please refer to the following link for SST- List of Taxable Service

- Please refer to the following link for Sales Tax (English Version): Customs - Sales Tax (English Version)

- Please refer to the following link for Sales Tax (Malay Version): Customs - Sales Tax (Malay Version)

- Please refer to the following link for Service Tax (English Version): Customs - Service Tax (English Version)

- Please refer to the following link for Service Tax (Malay Version): Customs - Service Tax (Malay Version)

SST Basic Information

- SST is only applicable for Manufacturers and not for Distributors and Retailers.

- SST has TWO separate acts, Sales Tax and Service Tax.

- SST should be filed as at bi-monthly (2 months - file once). This is different from GST, which are by monthly or quarterly filing.

- Example of SST basic filing cycle as per following table. Please take note that this is the basic filing cycle and submission. Customs may have emailed or notified your company if the filing cycle and submission date is different. Kindly follow the Custom's instructions if there is any.

Bi-monthly filing cycle | Last day of SST submission |

|---|---|

| Sept - Oct 2018 | 30 Nov 2018 |

| Nov - Dec 2018 | 31 Jan 2018 |

| Jan - Feb 2019 | 31 Mar 2018 |

| Mar - Apr 2019 | 31 May 2018 |

- Sales Tax accounts for 0%, 5% and 10% of tax rate, based on the list of Taxable Goods.

- Service Tax accounts for 6% of tax rate.

- Sales Tax should be filed following the date of Invoice issued.

- Service Tax should be filed following the date of payment received.

- To regard with this, it is advised to issue separate Invoice for Goods/ Sales and Service.

- The printed Invoice for SST should have the indication of INVOICE and not TAX INVOICE that was done during GST.

Proposed Supply Tax Codes:

SALES (CUSTOMER) | |

|---|---|

| Recommended Tax Code for Goods | Description |

| SRG10 | Sales with 10% Sales Tax |

| SRG5 | Sales with 5% Sales Tax |

| SRG0 | Sales with 0% Sales Tax |

| ZREG0 | Export Sales with 0% Sales Tax |

| ZRLG0 | Sales to Designated Areas/ Special Areas with 0% Sales Tax |

| ESG0 | Sales which are exempted from Sales Tax |

| OSG0 | Out of Scope (Goods) |

| Recommended Tax Code for Services | Description |

| SRS6 | Sales with 6% Service Tax |

| SRS0 | Sales with 0% Service Tax |

| ZRES0 | Export Sales with 0% Service Tax |

| ZRLS0 | Sales to Designated Areas/ Special Areas with 0% Service Tax |

| ESS0 | Sales which are exempted from Service Tax |

| OSS0 | Out of Scope Sales (Services) |

| Recommended Tax Code for Goods and Services | Description |

| NRCS | Not Registered for Service Tax |

| NRCG | Not Registered for Sales Tax |

Proposed Purchase Tax Codes:

PURCHASE (SUPPLIER) | |

|---|---|

| Recommended Tax Code for Goods | Description |

| TXG10 | Purchase Invoices with 10% Sales Tax |

| TXG5 | Purchase Invoices with 5% Sales Tax |

| TXG0 | Purchase Invoices with 0% Sales Tax |

| IMG10 | Imports with 10% Sales Tax |

| IMG0 | Imports with 0% Sales Tax |

| NRG0 | Not Registered for Sales Tax |

| Recommended Tax Code for Services | Description |

| TXS6 | Purchase Invoices with 6% Service Tax |

| TXS0 | Purchase Invoices with 0% Service Tax |

| IMS0 | Foreign Invoices with 0% Service Tax |

| NRS0 | Not Registered for Service Tax |

SALES

- The invoice can be filled in the EMP if invoice HAS tax code → SRG10, SRG5, SRG0

SERVICE

- The Invoices can be filled in the EMP if ALL condition below are fulfilled:

- The invoice MUST have Payment / Settlement (RCT)

- The invoice MUST tax code → SRS6, SRS0

- Filling is bi-monthly ( 2 months periods )

- SUM of RCT > SST, this is for partial Settlement done for 1 invoice.

INVOICE and RECEIPT

Documents | Scenario | Test Case | Expected Result | Remarks |

|---|---|---|---|---|

INV + RCT | Full Payment | INV = RM 106 (SST = RM 6) RCT = RM 106 | The INV will be filed, follow the Settlement date. | |

INV + RCT | Partial Payment | INV = RM 106 (SST = RM 6) RCT = RM 50 | The INV will be filed, follow the settlement date. Because the RCT amount is more than the SST amount. | |

INV + RCT | Partial Payment | INV - RM 1060 (SST = RM 60) RCT = RM 50 | The INV will NOT be filed. Because the RCT amount is lesser than the SST amount. | *Reason for following this method is because, in RCT, there is no Item Code. If the INV has many items, some with SST and some without SST, the RCT cannot identify that the payment is for which item code (with or without SST). |

INV + Multiple RCTs | Partial Payment | INV - RM 1060 (SST = RM 60) RCT 1 = RM 50 RCT 2 = RM 20 (Sum of RCT amount = RM70) | The INV will be filed, following the 2nd RCT settlement date. Because Sum of the RCT amount is more than the SST amount. |

INVOICE and Manual CM → Customer Credit Note only

Documents | Scenario | Test Case | Result | Remarks |

|---|---|---|---|---|

INV + Manual CM | Full Settlement | INV = RM 106 (SST = RM 6) Manual CM = RM 106 | The INV will be filed, follow the Settlement date. | |

INV + Manual CM | Partial Settlement | INV = RM 106 (SST = RM 6) Manual CM = RM 50 | The INV will be filed, follow the settlement date. Because the Manual CM amount is more than the SST amount. | |

INV + Manual CM | Partial Settlement | INV - RM 1060 (SST = RM 60) Manual CM = RM 50 | The INV will NOT be filed. Because the Manual CM amount is lesser than the SST amount. | |

INV + Multiple Manual CMs | Partial Settlement | INV - RM 1060 (SST = RM 60) Manual CM 1 = RM 50 Manual CM 2 = RM 20 (Sum of Manual CM amount = RM70) | The INV will be filed, following the 2nd Manual CM’s settlement date. Because the Sum of the Manual CM amount is more than the SST amount. |

INVOICE and Auto-created CM (SR)

>>> The SR created from INV, should have the same tax code. It is impossible for the tax code to be different for the linked INV and SR. If in 1 Invoice document, there are many items, some have SST and some does not have SST, based on the item codes user selected from Sales Return, the system will capture the tax code. Therefore, it is impossible for the tax codes to be different for the linked INV and SR.

Documents | Scenario | Test Case | Result | Remarks |

|---|---|---|---|---|

INV + SR (CM) | Full Settlement | INV = RM 106 (SST = RM 6) SR (CM) = RM 106 | The INV will be filed, follow the Settlement date. | |

INV + SR (CM) | Partial Settlement | INV = RM 106 (SST = RM 6) SR (CM) = RM 50 | The INV will be filed, follow the settlement date. Because the SR (CM) amount is more than the SST amount. | |

INV + SR (CM) | Partial Settlement | INV - RM 1060 (SST = RM 60) SR (CM) = RM 50 | The INV will NOT be filed. Because the SR (CM) amount is lesser than the SST amount. | |

INV + Multiple SR (CM) | Partial Settlement | INV - RM 1060 (SST = RM 60) SR (CM) 1 = RM 50 SR (CM) 2 = RM 20 (Sum of SR (CM) amount = RM70) | The INV will be filed, following the 2nd SR (CM) settlement date. Because the Sum of the SR (CM) amount is more than the SST amount. |

INVOICE and Multi Documents

Documents | Scenario | Test Case | Result | Remarks |

|---|---|---|---|---|

INV 1 + RCT 1 INV 1 & SR 1 (CM 1) CM 1 + INV 2 | Future Contra | INV 1 settled with RCT 1 Later, INV 1 has SR 1 (CM 1). The CM 1 is settled with INV 2. Note: The SR 1 is done for Item without SST. | If INV 1 has tax code SRS 6, then INV 1 will be filed. If INV 2 has no SRS6, then INV 2 will NOT be filed. | For INV 1, the RCT settled will be considered as the settlement document for INV 1. If the SR 1 has no tax code (which means user return Items without SST), then the future contra with INV 2, with no SRS6, the system will NOT file INV 2. |

INV 1 + RCT 1 INV 1 & SR 1 (CM 1) CM 1 + INV 2 | Future Contra | INV 1 settled with RCT 1 Later, INV 1 has SR 1 (CM 1). The CM 1 is settled with INV 2. Note: The SR 1 is done for Item without SST. | If INV 1 has tax code SRS 6, then INV 1 will be filed. If INV 2 has SRS6, then INV 2 will be filed. | For INV 1, the RCT settled will be considered as the settlement document for INV 1. If the SR 1 has no tax code (which means user return Items without SST), then need to double confirm with User if the transaction is correct, whereby INV 2 has SRS6 but CM 1 (SR 1) does not have SRS6. |

- Create Filing Cycle (Menu Path: Extended Modules > Malaysia GST > Tax Filing > Tax Filing Create)

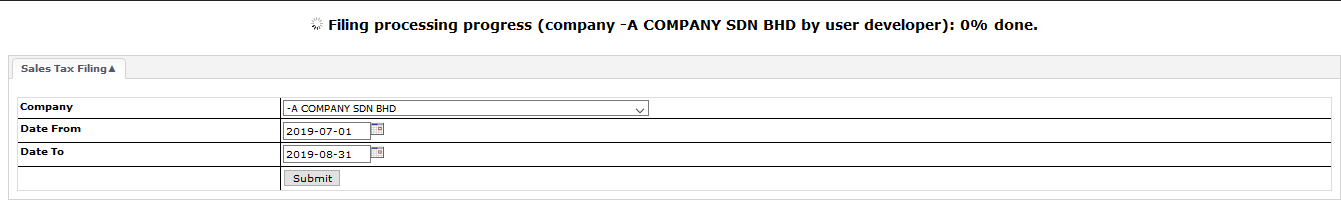

- Sales Tax Filing (Menu Path: Extended Modules > Malaysia SST > Sales Tax > Sales Tax Filing)

- Click the company

- Click the Date From and Date to

- Click Submit

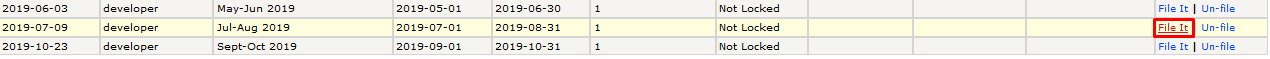

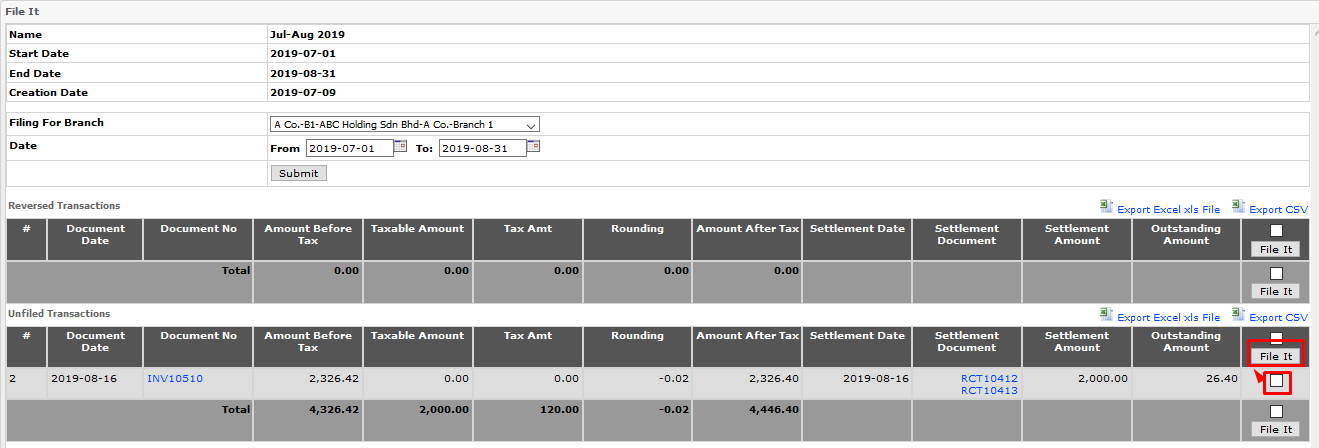

- Service Tax Filing (Menu Path: Extended Modules > Malaysia SST > Service Tax > Service Tax Filing)

- Choose the branch and click submit

- Click "File it"

- Chose the file and click "file it"

- SST-02 Report

- Section 10 → shows the Tariff Code (configured under item)

- Section 11 → shows the INV filed

- Section 13 → shows the CM filed

- Section 16 → shows TOTAL of Section 11 minus Section 13

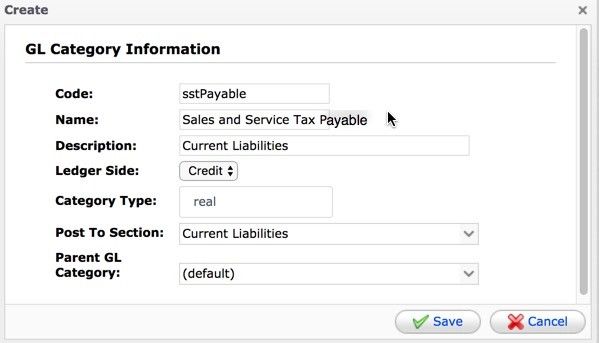

1. Add New Category for SST

Path: Accounting > Maintenance > Configuration > GL Category Maintenance

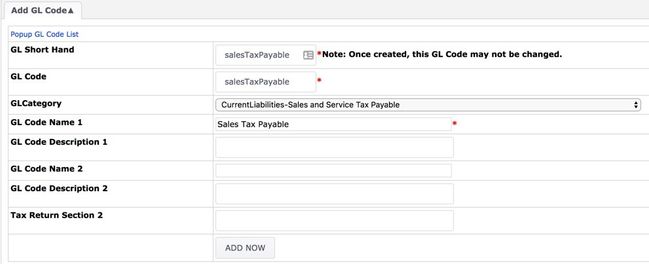

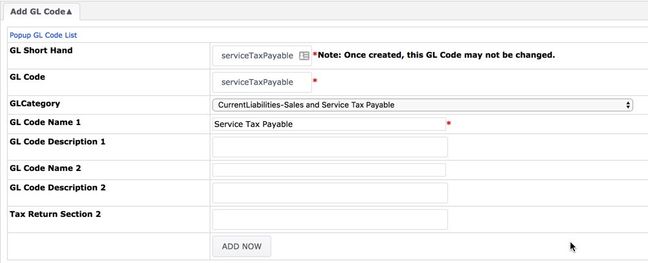

2. Add New GL code

Path: Accounting > Maintenance > Configuration > Add GL Code

for Sales Tax Registrant

for Service Tax Registrant

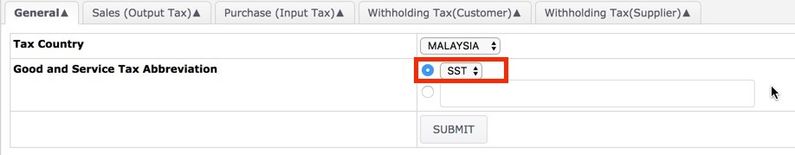

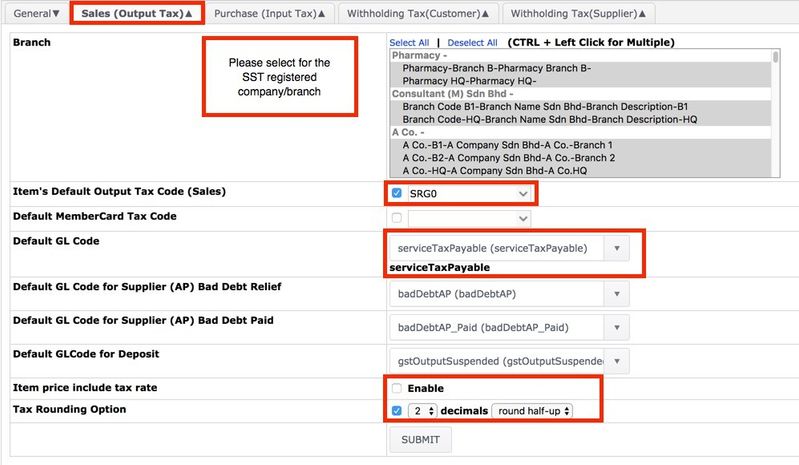

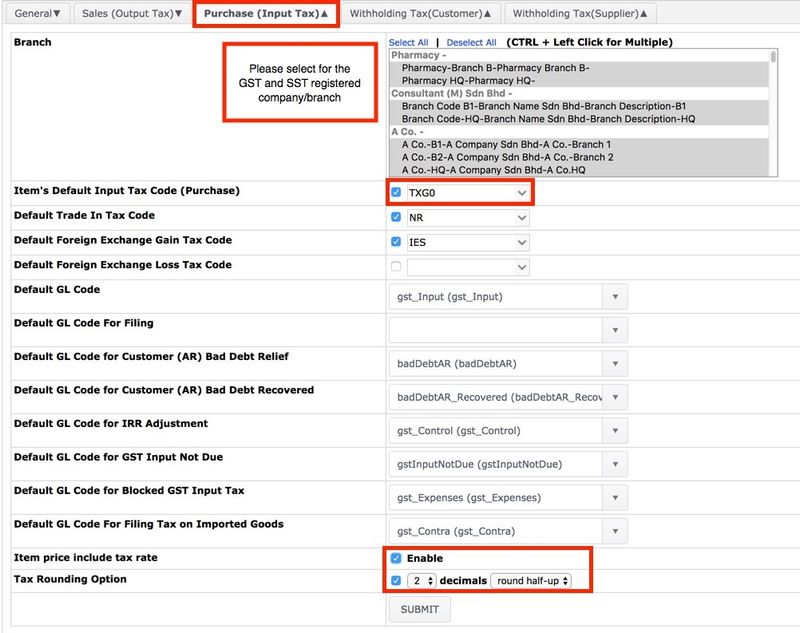

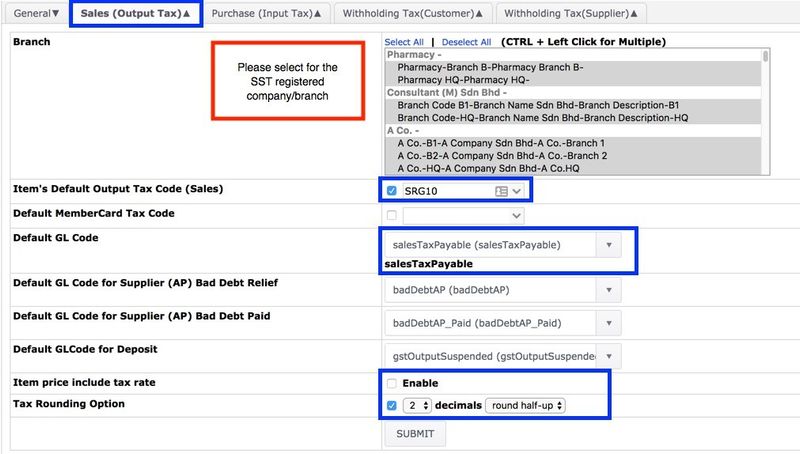

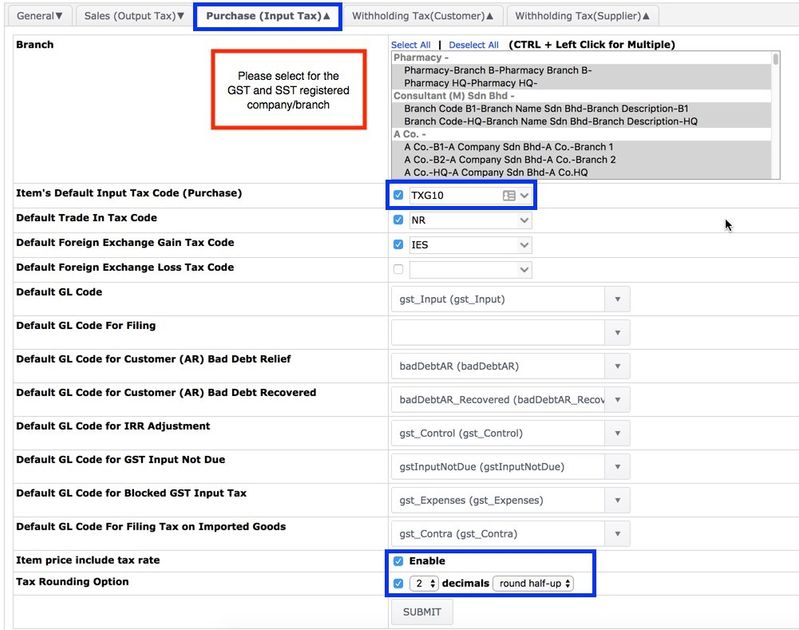

3. EMP Tax Configuration

Path: Control Panel > System Admin > EMP Configuration > Tax

General

Sales (Output Tax)

for Service Tax Registrant

Purchase (Input Tax)

for Service Tax Registrant

Sales (Output Tax)

for Sales Tax Registrant

Purchase (Input Tax)

for Sales Tax Registrant

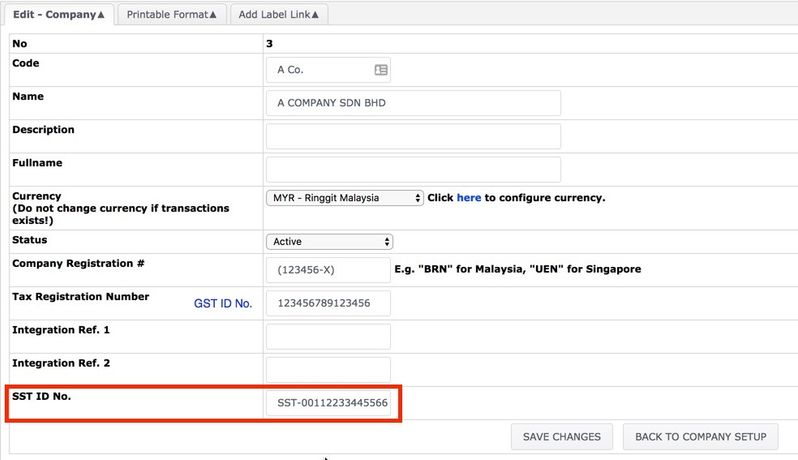

Path: Control Panel > Developer > Organisation Structure > Company

Search for company > Edit

- User needs to download the list of Item Codes from EMP system, update the CSV file with the New SST Tax Codes.

- Go to Inventory > Item > Item Listing

- Download the Item Listing and update the new tax codes.

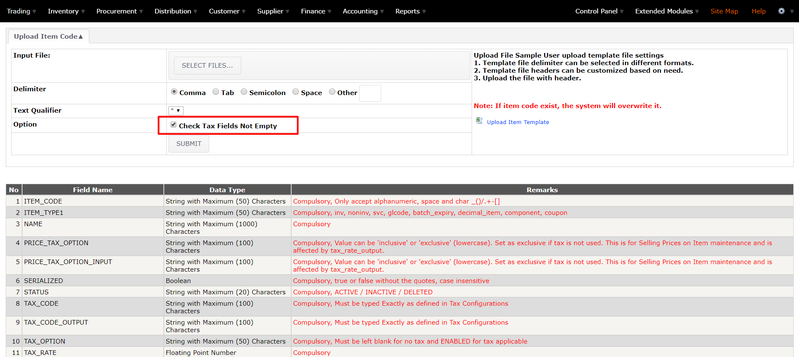

- Upload the CSV file to EMP system at the following function: Inventory > Item > Upload Item

- At the Upload Item Code function page, tick on the checkbox for Check Tax Fields Not Empty (as shown in the following screenshot)

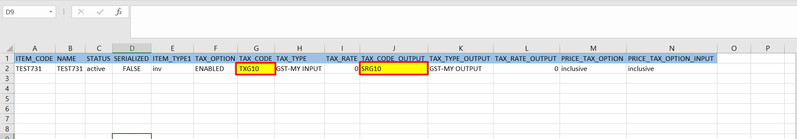

- Following is the example to edit the CSV file. User only needs to edit the Tax Code columns.

- User do not have to update Tax Type and Tax Rate column, as the system will auto-update the Tax Type and Tax Rate following the Tax Code keyed in.

Recommended Tax Codes for Items:

For Service Tax Registrant:

| Sales | Purchase | |

|---|---|---|

| Inventory/Goods | SRG0 | TXG0 |

| Service | SRS6 | TXG6 |

For Sales Tax Registrant:

| Sales | Purchase | |

|---|---|---|

| Inventory/Goods | SRG10 | TXG10 |

| Sales | SRS0 | TXS0 |

- User need to update the printable by themselves.

- Refer to the following link: Guide to Upload Printable Page in System

Private & Confidential