GST Final Submission - GST Exit

Disclaimer: The following are recommended solutions only. Please refer to any changes or latest updates from RMCD official website.

A) Filing Cycle

The following is the final filing cycle for GST period and GST exit.

For monthly submission will be as follows:

| Filing Cycle | Remarks |

|---|---|

| Aug 2018 |

|

| Sept 2018 - Dec 2018 |

|

For quarterly submission will be as follows:

| Filing Cycle | Remarks |

|---|---|

| Jul - Aug 2018 |

|

| Sept 2018 - Dec 2018 |

|

- For quarterly submission, the existing filing cycle would be Jul - Sept 2018 and Oct - Dec 2018.

- ** Please request from our Support team to edit the financial cycle if you need to proceed with GST Final Submission for Input Tax.

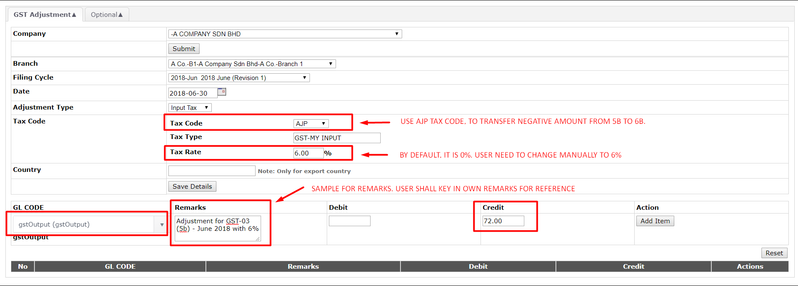

B) GST-03 (5b) and (6b) transfer negative amount

- For Filing cycle that falls in June, July and August 2018 Filing cycle, there are high possibilities of negative amount to be reflected at (5b) and (6b).

- User needs to do GST adjustment using AJP and AJS, to transfer the amount from (5b) to (6b) and vice versa.

Sales Return (Negative amount at GST-03 5a)

Scenario 1: If there have SR being created in June 2018 with 6% gst, GST-03 (5b) might result in negative amount. TAP file does not allow negative amount to be submitted.

Answer 1: User need to do GST adjustment with AJP tax code to Transfer the negative amount from GST-03 (5b) to (6b) to Claim back the GST amount

The following are the suggested steps to perform GST adjustment for negative amount at (5b)

Example: GST-03 (negative amount at 5a and 5b due to SR with 6% gst in June 2018)

5a. : (RM 1272)

5b. : (RM 72)

Result:

6a. : -

6b. : RM 72

Note: No principle amount for AJP

Menu Path: Extended Module > Malaysia GST > Tax Filing > GST Adjustment

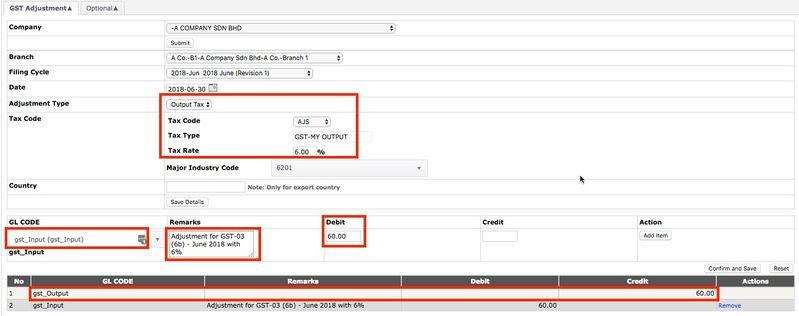

Purchase Return (Negative amount at GST-03 6a)

Scenario 2: If there have PR being created in June 2018 with 6% gst, GST-03 (6b) might result in negative amount. TAP file does not allow negative amount to be submitted.

Answer 2: User need to do GST adjustment with AJS tax code to Transfer the negative amount from GST-03 (6b) to (5b) to PAY back the GST amount

The following are the suggested steps to perform GST adjustment for negative amount at (6b)

Example: GST-03 (negative amount at 6a and 6b due to PR with 6% gst in June 2018)

6a. : (RM 1200)

6b. : (RM 60)

Result:

5a. : -

5b. : RM 60

Note: No principle amount for AJS

Menu Path: Extended Module > Malaysia GST > Tax Filing > GST Adjustment

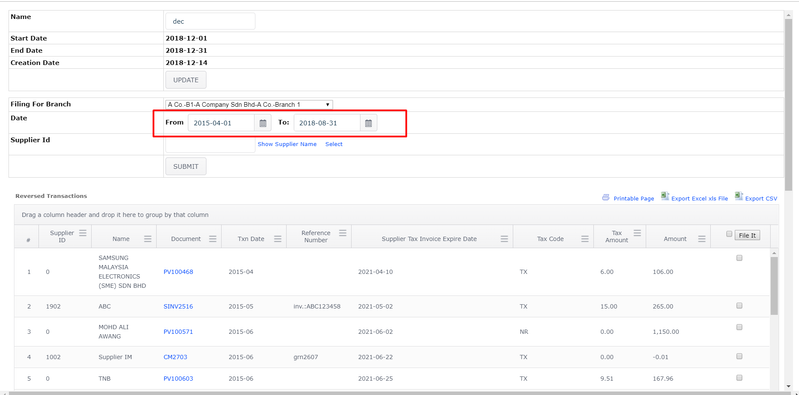

C) Input Tax Filing - Final claim

- For the final GST submission, user needs to generate all the remaining documents that has not filed.

- Go to Extended Module > Malaysia GST > Tax Filing > Input Tax Filing

- User needs to ensure the date generated should be from 2015-04-01 till 2018-08-31.

- All the Input Tax documents up to transaction date of 2018-08-31 should be filed. The amount will be reflected at GST-03 (6a) and (6b).

- For Input Tax GL, all the amount shall be transferred to gstPayable GL upon filing all the Input Tax documents.

- Upon transferring Input Tax to gstPayable GL, there will be Debit balance. This amount in the Balance Sheet will be carried forward till the refund from Customs is received.

D) Output Tax Filing

- User needs to file output tax from Sept - Dec 2018.

- For the period of Sept 2018 - Dec 2018, there should not be any Invoice documents with GST.

- However, it is possible to have Sales Return documents with GST 6% from the Invoices created during GST period.

- After run filing for Output Tax Sept - Dec 2018, the amount at GST-03 5a and 5b might be negative due to Sales Return.

- 5a amount is negative due to Supply amount from Sept - Dec 2018, are all Sales Return.

- User needs to do GST adjustment from Note B above; the amount from 5b will be transferred to 6b.

- For 5a, user do not need to do adjustment.

- When submitting the GST-03 via TAP, user do not need to submit 5a amount which shows negative.

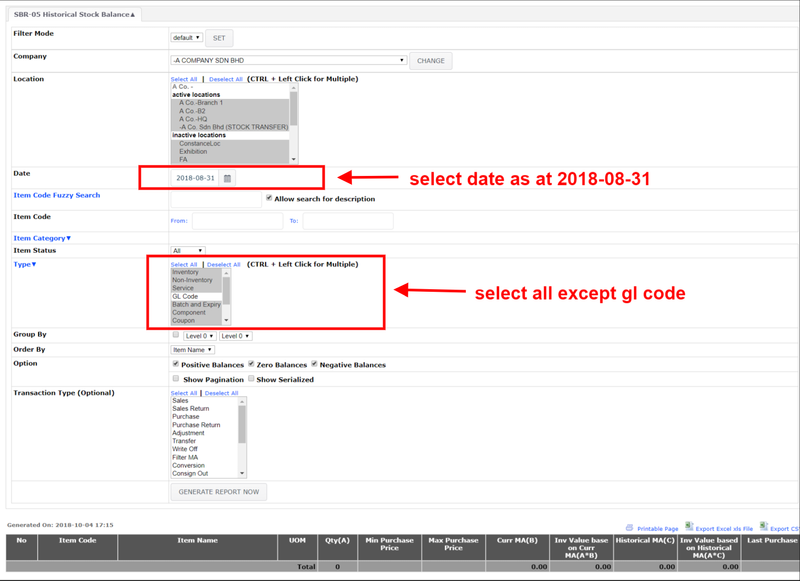

E) Declare Stock and Capital Goods

Stock

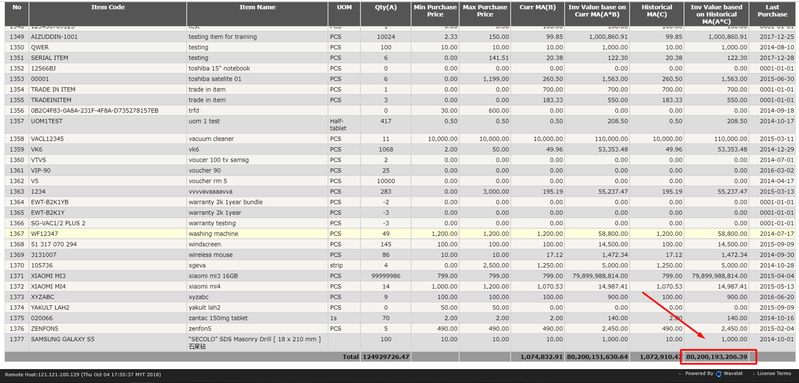

- Generate SBR-05 as at 2018-08-31 to get the final stock value.

Capital Goods

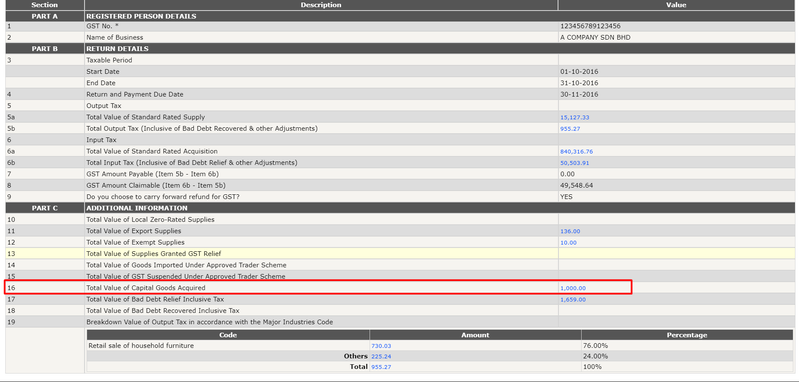

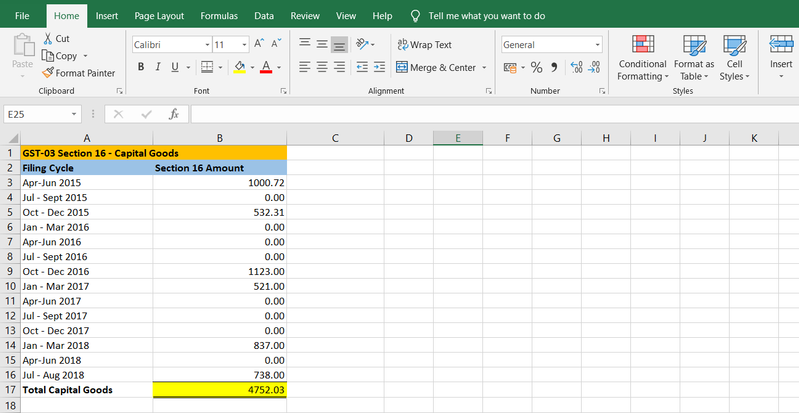

- For Capital Goods, user needs to refer to the printed TAP form from filing cycle from April 2015 till August 2018, and sum up all the amount from Section 16.

- Preferably, to sum up all the Section 16 in excel file as per sample below:

** The amount from SBR-05 for stock and sum of Section 16, should be added manually at GST-03 Section (5a) when submitting the tax return using TAP form, the above worksheet as supporting documents

F) Balance Sheet GST GL Codes

- User needs to be examine the GST GL codes which are reflected at the Balance Sheet, as these amounts will be carried forward to the following year if it is not cleared.

- After all the GST amount has been filed and any error has been rectified, if there is still balance at the GST GL's, kindly refer to Auditors or Consultants.

- The following are the GST GL Codes, possibly to be still reflected under the Balance Sheet.

- gstInput

- gstOutput

- gstOutputSuspended

- gstPayable

- gstControl

- gstContra

- badDebtAR

- badDebtAR_Recovered

- badDebtAP

- badDebtAP_Paid

- Any other GST GL's reflected under Balance Sheet

Note: Several GL Codes listed above may not be appearing in your system. Different companies may have different GL names.

G) Bad Debt Treatment

- User is advised to process the AR Bad Debt Recovered and AP Bad Debt Paid and clear the accounts by the last GST filing cycle and submit by 2018-12-29.

Reference:

Please refer to custom website for the latest update

Private & Confidential