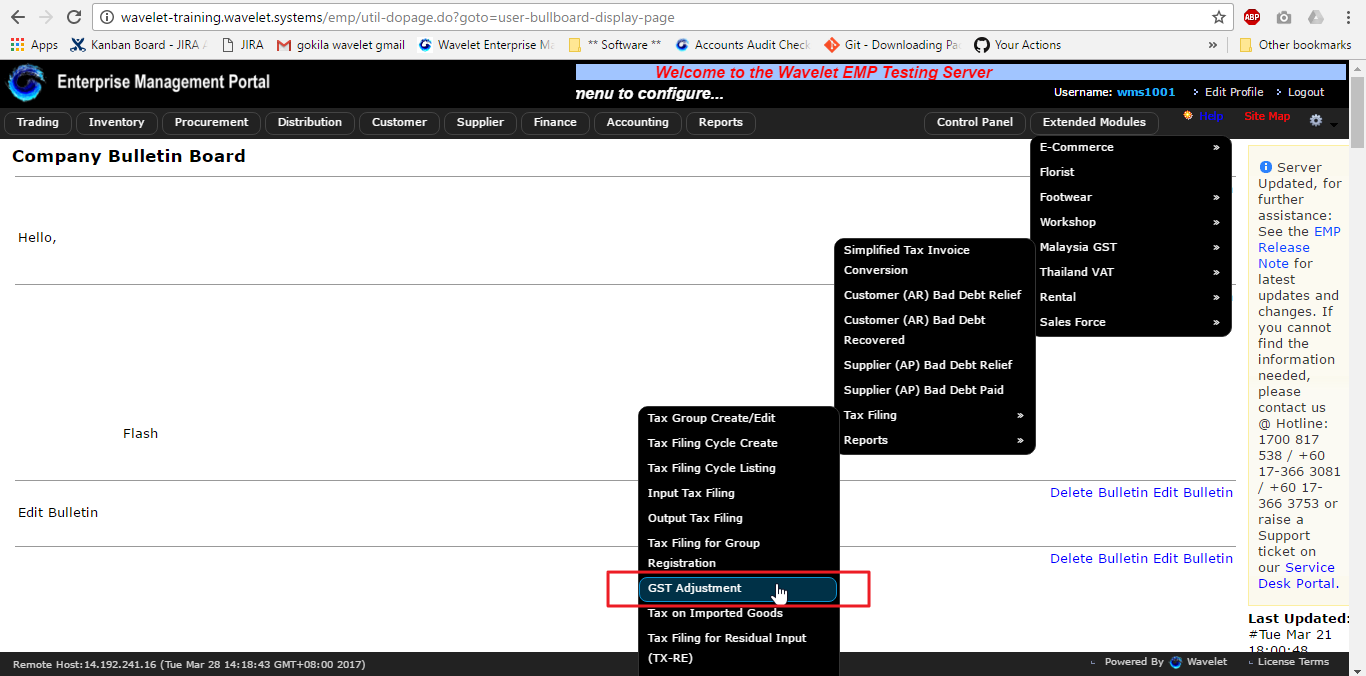

Menu Path: Extended Modules > Malaysia GST > Tax Filing > GST Adjustment

Kindly take note on the navigation path shown below: navigation pathway (refer to the image below):

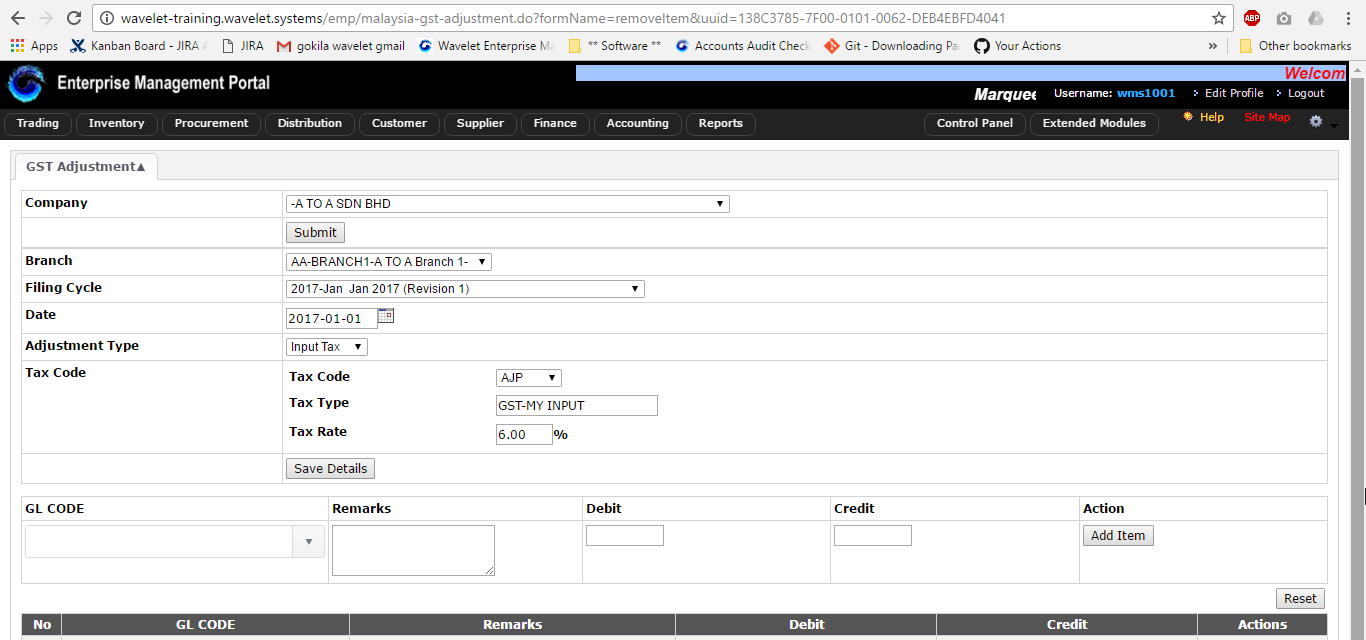

The image below shows the main interface that the user will be seeing when they get access into the EMP system.

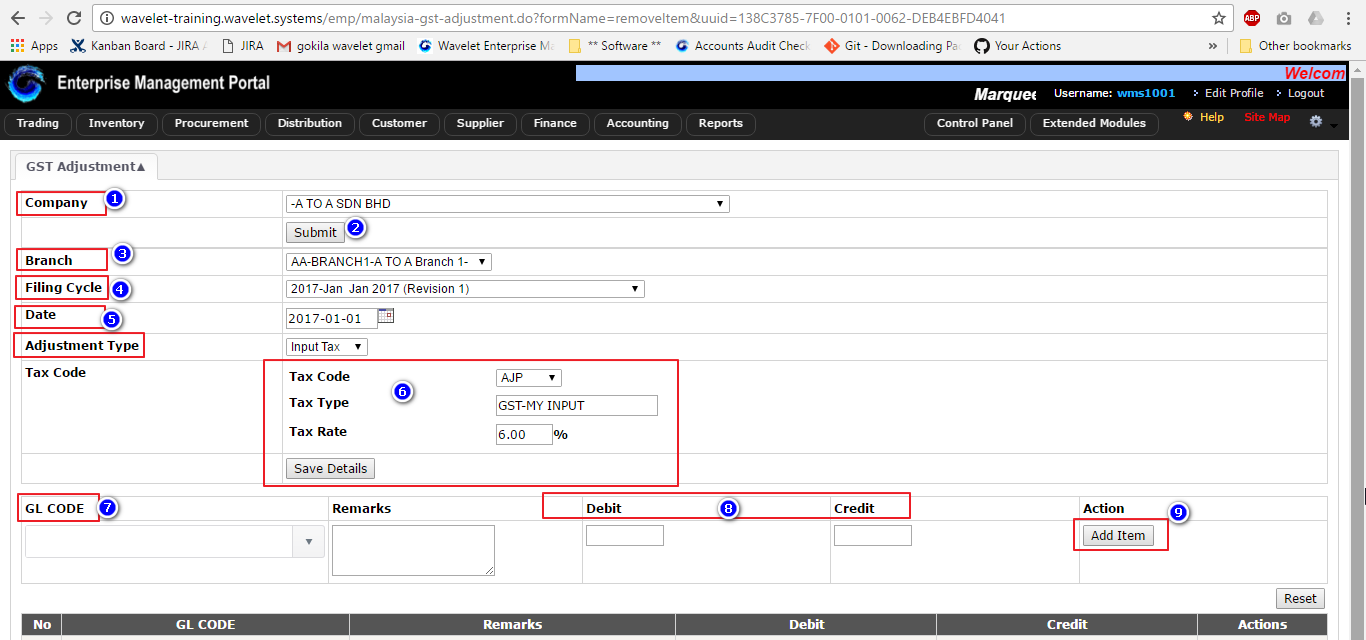

The image below shows the steps of how the user may key in / select the information accordingly one after another.

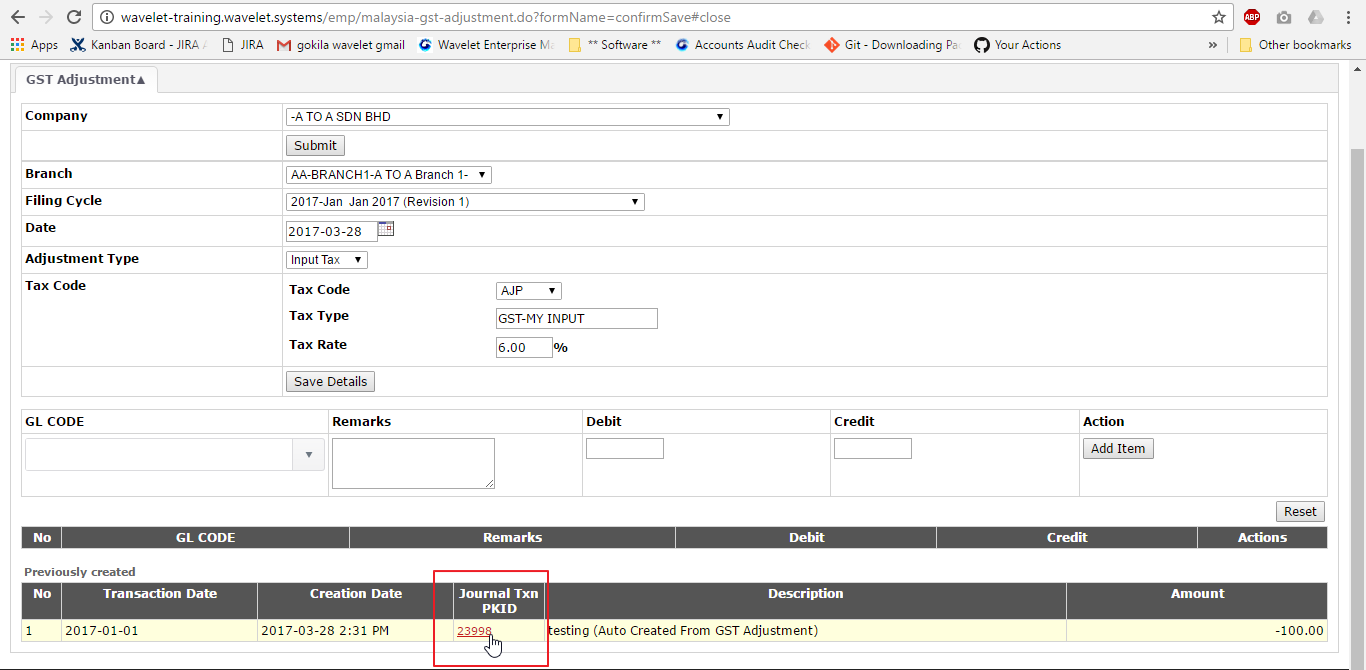

Usually the Journal Txn will be created after the user confirm and save their GST Adjustment transaction. This will automatically create the Journal Txn PKID as shown in below image.

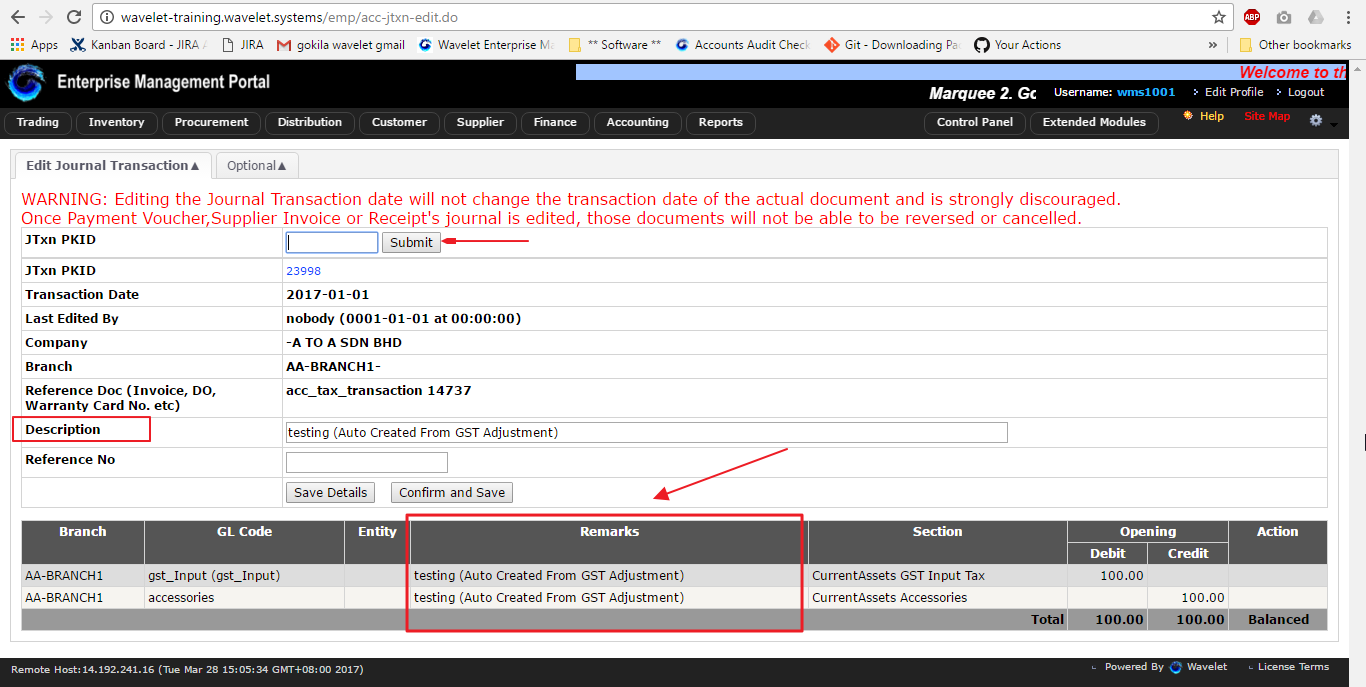

The new enhancement has actually allowed user to view the remarks when they does the GST Adjustment. This simply means after user done with the GST Adjustment, they may trace the journal transaction(using the PKID) to see the remarks stated earlier on during the GST Adjustment transaction by user.

To get access to this, user can navigate to Accounting > Journal and Ledger > Edit JTxn

The image below shows the Journal Transaction that can be traced and it includes / displays the "remarks" that user have key in during the GST Adjustment process as mentioned in the above.

Related Wiki Pages:

Found 5 search result(s) for GST Adjustment.