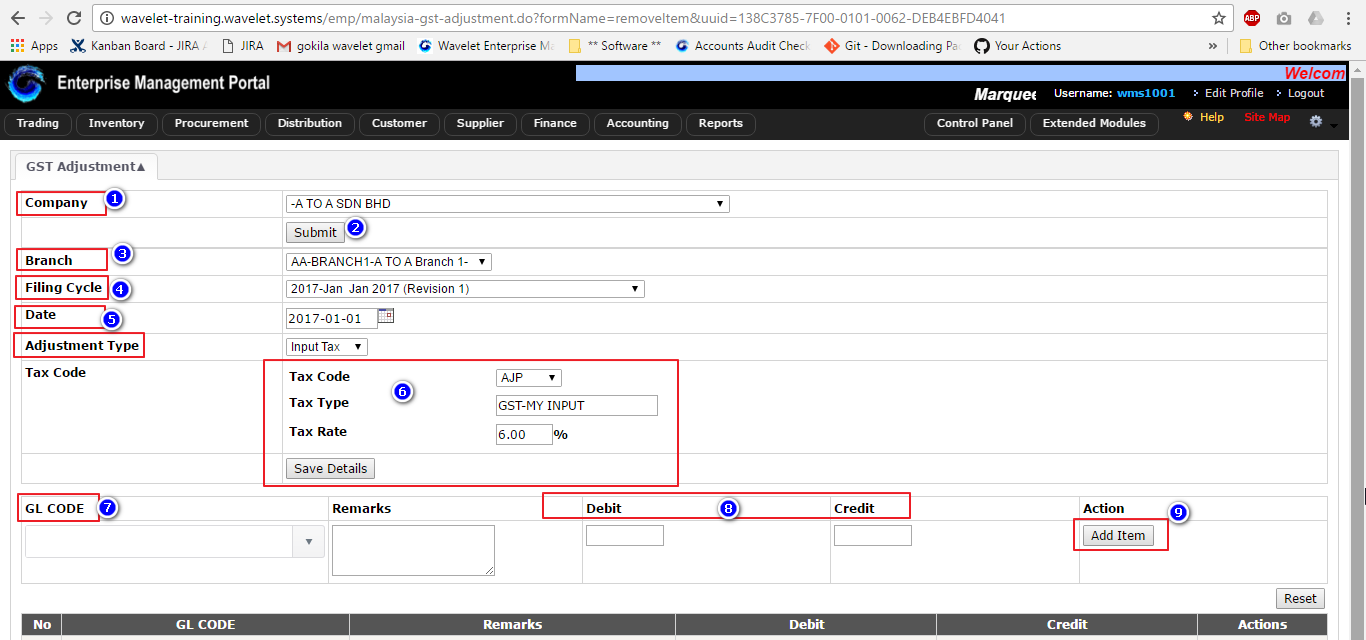

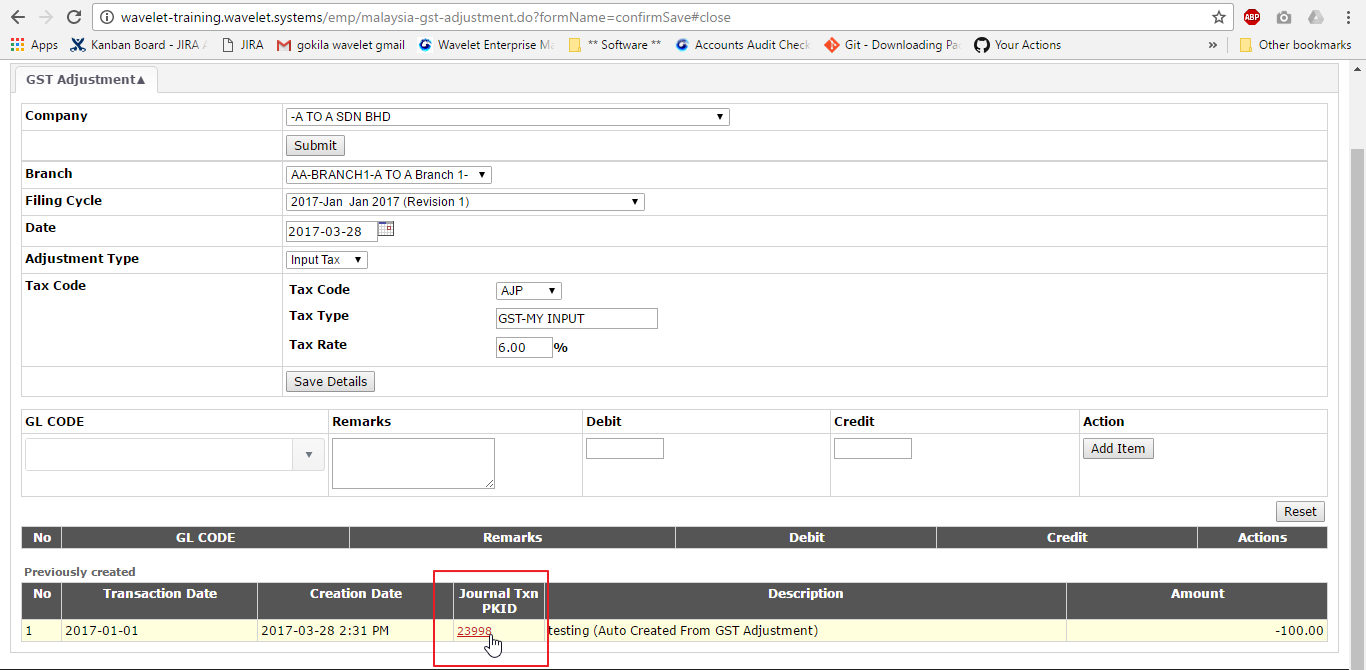

Menu Path:Extended Modules > Malaysia GST > Tax Filing > GST Adjustment

The image below shows the steps of how the user may key in or select the information accordingly.

- Select Company and Click Submit

- Select Branch

- Select Filling Cycle → refer to Tax Filling Cycle Listing

- Select Date

- Select Adjustment Type → input or output tax

- Select Tax Code → refer for the adjustment tax code

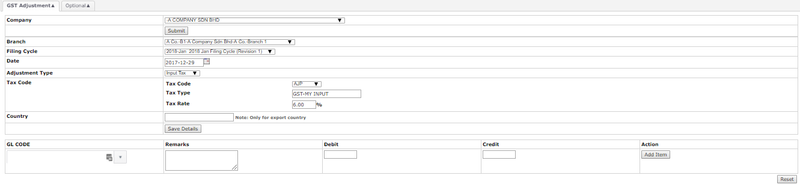

- Key in Country → only for export country

- Click Save Details

- Key in GL Code, Remarks, Debit or Credit

- Click Add Item

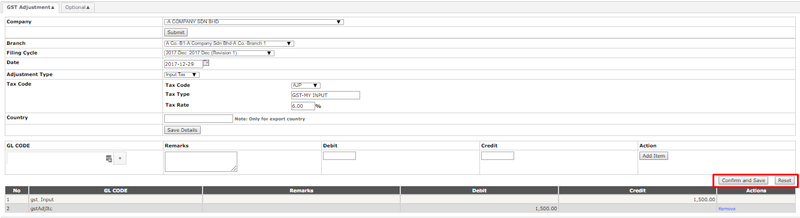

- Click Confirm and Save → to proceed create the GST adjustment

- Click Reset → to refresh the whole page

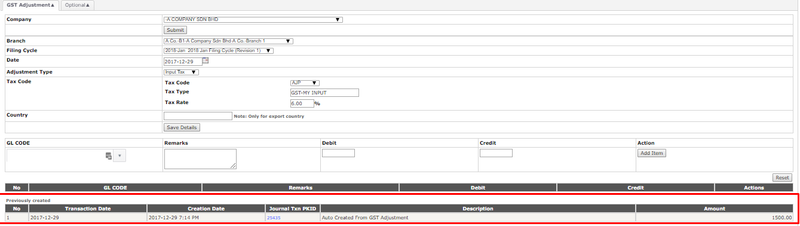

- The Journal Txn will be created after the user confirm and save their GST Adjustment transaction.

- This will auto-create the Journal Txn PKID as shown in the image below.

- The new enhancement allows user to view the remarks on the Journal Txn when the GST Adjustment is performed.

- To get access to this, user can navigate to Accounting > Journal and Ledger > Edit JTxn

- The image below shows the Journal Transaction that can be traced as per the above navigation.

...

- and shown as 'previously created' transaction

NOTES:

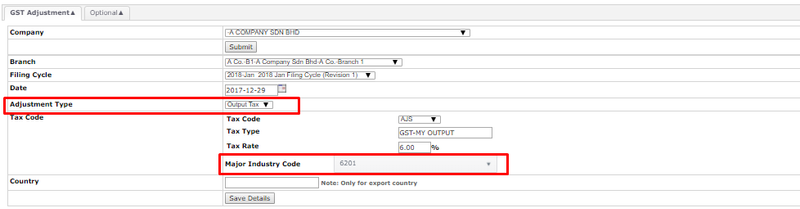

- MISC Code (Major Industry in Sales Code) need to be selected if the 'Adjustment Type' is OUTPUT TAX

Related Wiki Pages:

...