Supplier Consignment

Supplier Consignment

GST treatment for CONSIGNMENT SALES

- In the case of consignment goods, the basic tax point with regard to the time of supply is at the time when it becomes certain that the taxable supply has taken place or twelve months after the removal of goods, whichever is the earlier.

- 22. Consignment sale is a trading arrangement in which a consignor sends goods (consignment goods) to a consignee who pays the consignor only when the goods are sold. The basic tax point for consignment goods is the date of sales statement issued by the consignee or twelve months after delivery date of the goods whichever is the earlier.

- 23. If the consignor issues a tax invoice within 21 day from basic tax point, then time of supply becomes the date of tax invoice issued. However if tax invoice issued after 21 days period, then the time of supply is the basic tax point.

Wavelet EMP Configuration and Process Flow

2. EMP Configuration

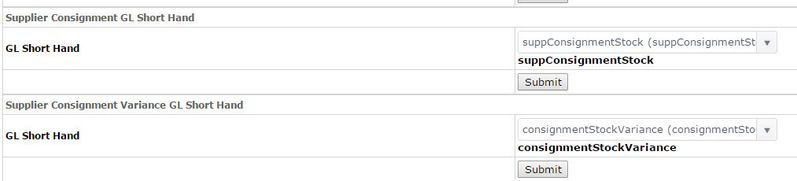

2.1 Control Panel > System Admin > EMP Configurations > Procurement

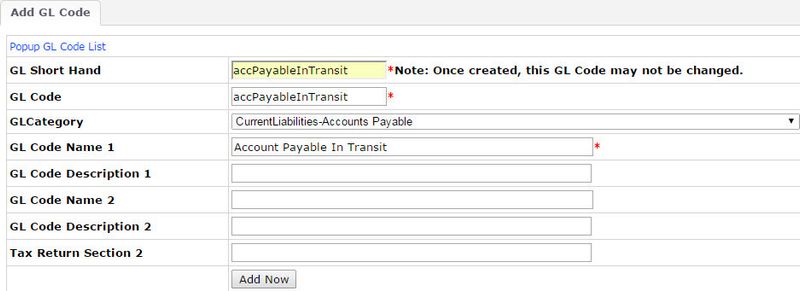

Account Payable Not Due GL Short Hand: Select: accPayableInTransit

2.2 Control Panel > System Admin > EMP Configurations > Procurement >

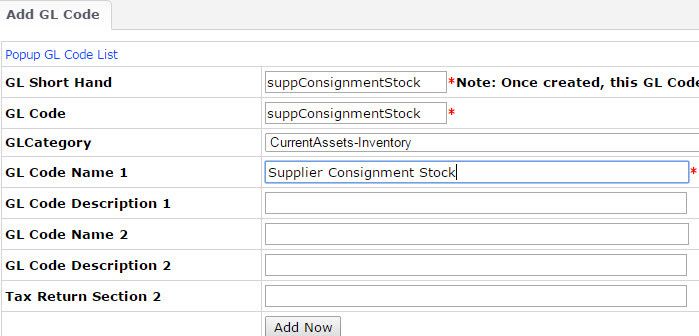

Supplier Consignment GL Short Hand > Select: suppConsignmentStock

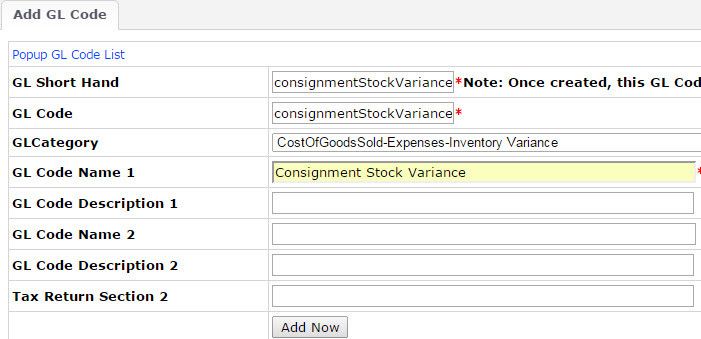

Supplier Consignment Variance GL Short Hand > Select: consignmentStockVariance

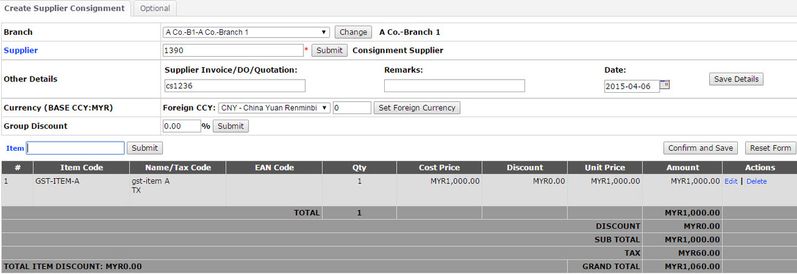

3. Received Consignment Stock from Supplier

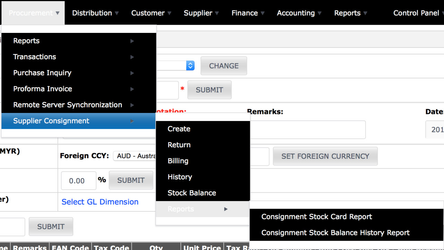

Procurement > Supplier Consignment > Create

- the UI for this function is similar to Direct Receiving Stock (GRN)

- however, the document that will be created is called Supplier Consignment In (SCI). The tables involved are :

- inv_consignment_index

- inv_consignment_item

- inv_stock

- inv_stock_delta

- acc_journal_transaction

- acc_journal_entry

- Must Keyed in the Consignment Value and record the gst

- it will not create the Supplier Invoice (SINV)

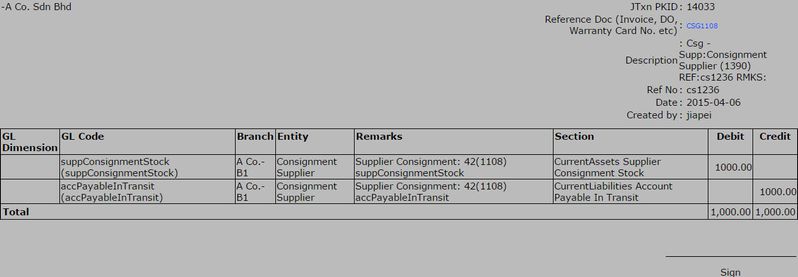

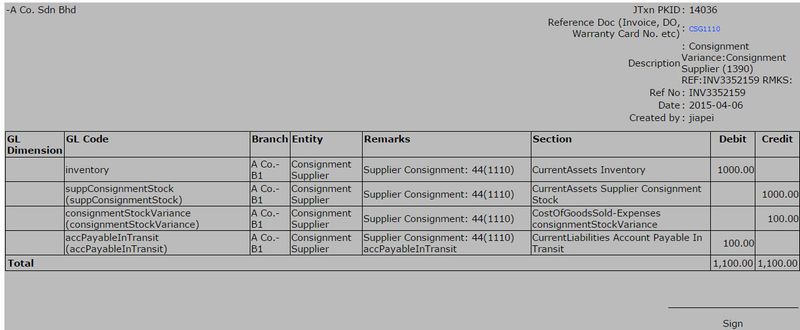

sample JTXN @ RM 1000 + 6% GST

Debit Credit suppConsignmentStock 1000 This GL is taken from EMP Configuration > Procurement > Supplier Consignment GL accPayableInTransit 1000 This GL is taken from EMP Configuration > Trading > Account Payable Not Due GL To view the Journal Entry: Accounting > Journal and Ledger > Jtxn Listing

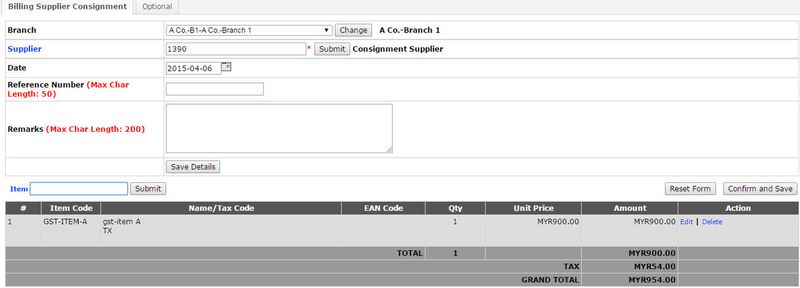

4. Sold out and send statement to Supplier, Received Supplier Tax Invoice

Procurement > Supplier Consignment > Billing

- 1. specify the supplier, branch, date, remarks, reference number (Supplier Tax Invoice no)

- 2. add item by selecting from a list of items that the supplier has yet to bill

- however, the document that will be created is SINV + Supplier Consignment Convert (SCC)

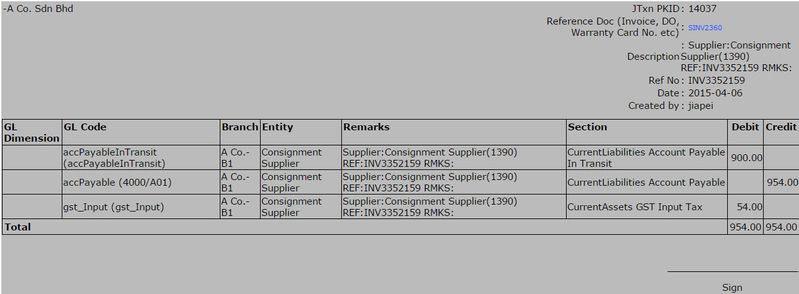

- Changes sample JTXN (Let’s say supplier bills cheaper @ RM 900 + 6% GST)

Supplier Consignment Convert (SCC)

Debit Credit inventory 1000 This will follow the consigned in price suppConsignmentStock 1000 This will follow the consigned in price consignmentStockVariance 100 Difference btw consigned in price and actual billing price accPayableInTransit 100 consignmentVariance * -1

- Supplier Invoice (SINV)

| Debit | Credit | ||

| accPayableInTransit | 900 | This will follow the actual supplier price | |

| accPayable | 954 | This will follow the actual supplier price | |

| gst_Input | 54 | This will follow the actual supplier price |

- GST will only be recorded for the SINV

-| gst_Input| XXX | | This GL is taken from Input Tax Default GL Code for filling

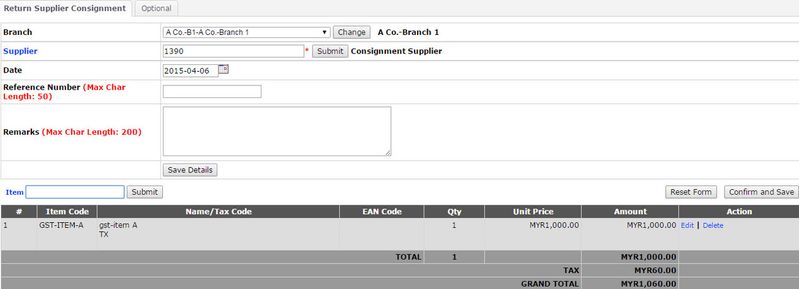

5. Un-sales items, return back to supplier (When return to supplier without billing)

Procurement > Supplier Consignment > Return

- the document that will be created is called Supplier Consignment Out (SCO). The tables involved are :

- inv_consignment_index

- inv_consignment_item

- inv_stock

- inv_stock_delta

- acc_journal_transaction

- acc_journal_entry

- it will not create the CM

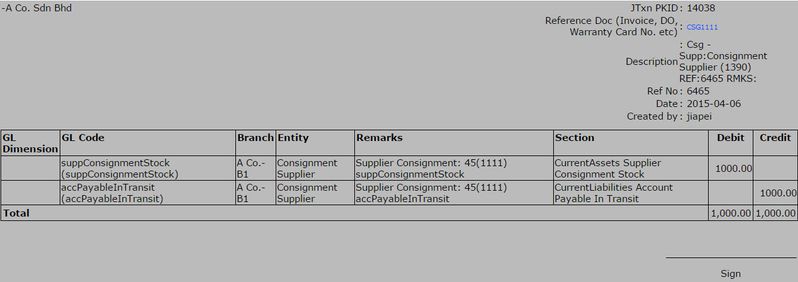

Changes sample JTXN @ RM 1000

Debit Credit suppConsignmentStock 1000 This will follow the consigned in price accPayableInTransit 1000 This will follow the consigned in price

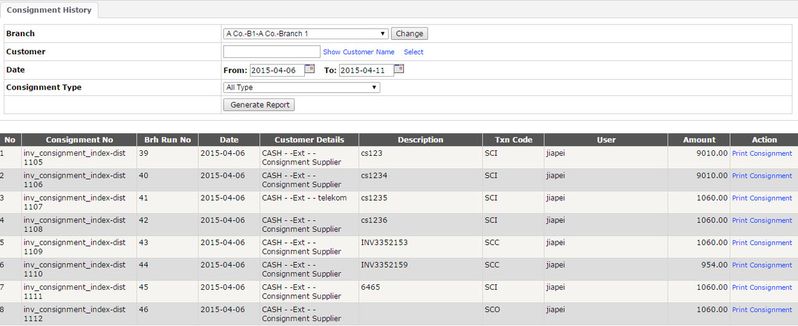

6. Supplier Consignment Listing

Procurement > Supplier Consignment > History

Consignment Type summary

| Consignment Type | Description | Transaction |

|---|---|---|

| SCI | Supplier Consignment In | Create |

| SCO | Supplier Consignment Out | Return |

| SCC | Supplier Consignment Convert | Billing |

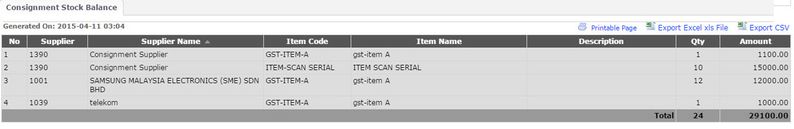

7. Supplier Consignment Stock Balance

Procurement > Supplier Consignment > Stock Balance

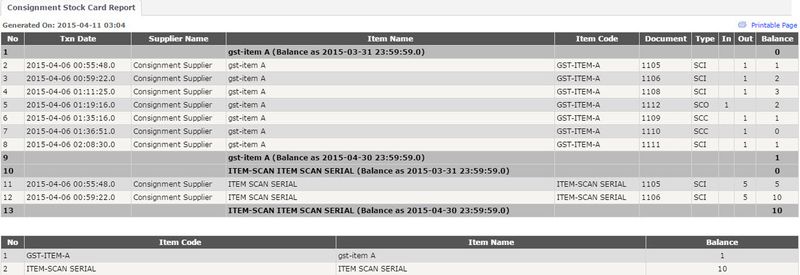

8. Supplier Consignment Stock Movement Report

Procurement > Supplier Consignment > Reports > Consignment Stock Card Report

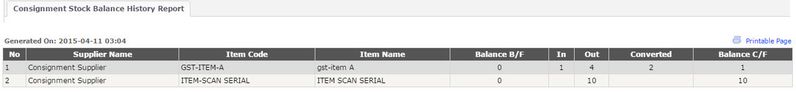

9. To view particular date report (e.g Balance as at 31 March 2015)

Procurement > Supplier Consignment > Reports > Supplier Stock Balance Historical Report

10. Related Permissions

Control Panel > System Admin > Manage User > Configure Role Permission

10.1 Procurement Module >

Create Supplier Consignment By Branch

Return Supplier Consignment By Branch

Billing Supplier Consignment By Branch

Supplier Consignment Batch & Expiry Adjustment

Supplier Consignment History Report By Branch

Supplier Consignment Stock Balance By Branch

10.2 Distribution Module > Consignment Stock Balance By Branch is for

- Supplier Consignment History Report By Branch

- Supplier Consignment Stock balance By Branch

issues reference:

Found 5 search result(s) for Supplier Consignment.

Private & Confidential