Extra Knowledge Q & A

Question 1

When wavelet pull the data for reporting - does it do so by GL Short Hand or GL Code where I am coming from is that for BEP and LP, the same acc type can have 2 different GL code

eg Trade Debtors - BEP 3000/000

Trade Debtors- LP 7103/000

therefore in wavelet - do we create same acc type with 2 GL code as in UBS?

Answer:

Yes in financial statements. You have the option to show GL code and its description when generating the financial statements.

The customer(debtor) account in Wavelet system is automatically linked to accReceivable GL code in default, so currently did not support other GL code like supplier(creditors).

Suggestion:

- If you are not having any transaction(e.g. Sales/Purchases, payment etc), but only manual journal entries/transaction, then you can create GL code into the system.

- Besides, the GL code created will appear in two companies(namely Be-P and LP) GL code list

- So they can be reused, but each company keep its own figure. (e.g. Be-P has paid RM 1,200 in insurance expenses, in LP has paid RM 1,000 in insurance expenses, in their own trial balance and P/L, it will show its figure only, i.e. Be-P insurance = 1,200; LP insurance = 1,000.)

- If there is transaction dealing with the debtor, then you just need to create customer/debtor account without GL code. To check the individual AR balance, you can use Historical AR report or Monitor Outstanding Document to view it.

Question 2

The GL category or acc type is more precise than UBS.

For example : wavelet FA - you have building/general FA/ etc .Whereas USB - they are all categorized as FA

The reason for asking is if I get the UBS chart of account to be upload to wavelet,

can the system accepts or do we need to adjust it to wavelet requirement

Answer :

In UBS, there is only 2 level of categorizations:

First level = Session category ( e.g. FA, CA, CL etc)

Second level = GL code (e.g. motor vehicle)

However, in Wavelet, we provide at least 3 level of categorizations:

First Level = Session category (e.g. FA, CA, CL etc)

Second level = GL category (e.g. General Expenses)

Third Level = GL shorthand/code (e.g. insurance)

In this way, you can group the GL code under one category, so it would not show you all GL Codes in financial statement unless you want to drill down to view each in details. Below is the sample of P/L statement.

Question 3

Item type description:

- INVENTORY - most default and normal item type, GRN and INV affect the stock balance and it cannot be less than zero, has cost.

- NON-INVENTORY - used to assign temporary item created under workshop module, works like inventory type, but not frequent stock in goods, used most in workshop environment. Auto created in Purchase Non Stock function in workshop module.

- SERVICE - service type items, GRN of this type of goods is unnecessary, stock balance can be negative as no GRN but has sales.

- GL CODE - miscellaneous items that need to be recorded in GL code apart from inventory and service, sales and GRN of this type of goods directly appear to the related GL code

- BATCH AND EXPIRY - contains batch number and expiry date as compulsory fields for this item type, like serialized items, must enter one batch number when GRN and sales. Common item type in pharmacy or FMCG industry.

- COMPONENT - was designed to work with BOM, but has been discontinued, works as normal inventory type now.

- COUPON - serialized item type, GRN without cost, and must stock out for customer before it can be used.

- DECIMAL ITEM - designed to allow decimal place in item quantity when GRN or sales, especially for goods sold in different volume.

- WARRANTY - a preset item type with warranty GL code, works like GL code but the GL code cannot be changed to others.

Question 4

The customer below came to order the CPAP machine (106379) So, may I know how to transact this in wavelet?

Answer :

In this case, you can use Create Sales Order. Same logic as injection package, customer came to order(with/without deposit) an item, user record it by using Create Sales Order. Once the item has stocked in(GRN in Wavelet), branch prepared to sell/deliver the item to the customer, then user can Create Invoice, load the Sales Order, and proceed to normal sales/stock out.

Because if we never stock in, it will not appear the stock list. So, we cannot do the transaction. As long as the item is available in the item list, user can Create Sales Order to record such transaction.

Until the actual goods had stocked in, user can proceed to Create Invoice, as above explanation.

Question 5

Can I change the item cost price for branch that already upload in the system?

The problem is item a already do transaction in LIS with the price is rm 2.24 before using wavelet. Then he want to create invoice in wavelet with price rm2.24 after discount. But the transaction can't be done due to the cost price is rm 2.50. I already change the minimum price 2.10, but still can't do transaction due to the cost price for that item in rm2.50. Kindly advise.

Answer:

Minimum Price in Wavelet refer to a price indicator, like discount in the hypermarket, red means discount 20%, green means discount 40% and etc.There are two ways to resolve such problems:

Allow user to sell below cost - by configure its permission to sell below cost

Not appropriate if such situation is rarely happened and it would violate management control.

Reset MA(Moving Average) - Inventory > Reset MA > Reset MA

This is to adjust the moving average cost of the item, due to variance of purchase cost (GRN), so system can reflect the true or correct cost of the goods. Can be used when need to adjust the cost price to allow user/branch to sell in lower price/give more discount(not lower than cost). Reset Ma GL code is subjected to the adjustment purpose, i.e. why it was adjusted higher/lower, and thus reflect in the accounting.

Question 6

May i know when we want adjust the uom to the correct uom for each item due to i really got confuse when need to check the stock tally or not. I need to check the grn uploaded and compare with the uom state and the price to make sure which uom is correct.

In order to upload the item, balance and cost price for the branch, you mention that have 2 ways are upload grn and direct receive stock.

For upload grn i already know how to do it, but for direct receive stock, i do have problem in the red box as below. It because if I want to stock in the item due to balance from that branch is zero, i dont have any supplier invoice or PO.

Kindly advise how I suppose to do the direct receive stock.

Answer:

- In this case, due to wrong UOM quantity in GRN, it results such post-consequential trouble.

The best way to overcome such problem is to ENSURE stock take is in correct UOM quantity, so to avoid R-I-R-O(Rubbish in, rubbish out). - Under normal circumstances, this column is used to record the Supplier Invoice / Delivery Order document no to trace back this GRN when needed.

However, in this case, if you use Direct Receiving Stock to manually stock in OPENING STOCK for the branch, for sure you would have no such information/document.So you may use "Opening stock as at dd-mm-yyyy" or other reference phrases to label this GRN, as it is a compulsory field.

This solution is assuming user using Direct Receiving Stock to bring in the opening stock of the branch, not applicable to other situation.

Question 7

How to check variance between MA cost and balance sheet inventory GL code?

Answer:

Inventory > Reports > Stock Reports

Generate SBR-05 Historical Stock Balance Report to compare MA cost and accounting inventory value.

Question 8

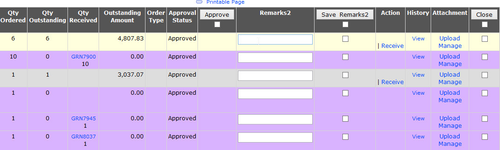

Faq on PO

8a. How to cancel a PO

Answer:

To cancel a PO, it is similar to current close PO function which is available in PO Listing, the last column).

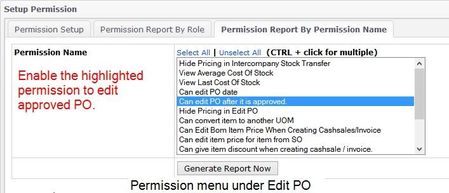

8b. How to edit an approved PO

Answer:

To edit an approved PO, you have to enable the permission to edit PO after it is approved(refer to photo below).

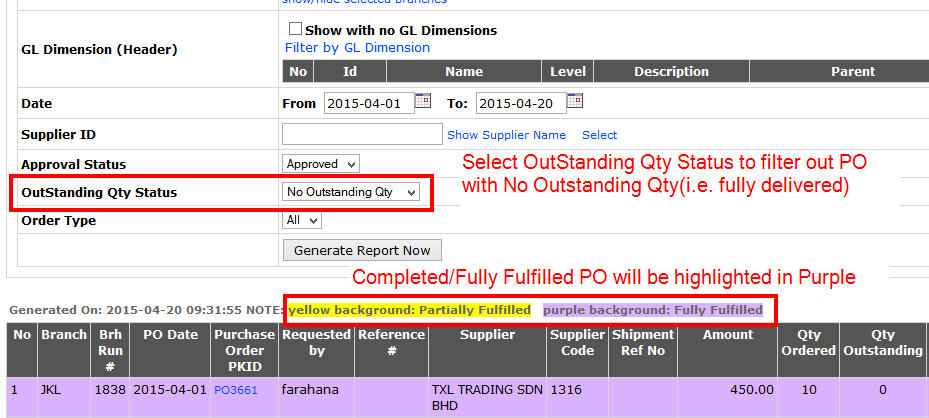

8c. How to identify completed/delivered PO

Answer:

To identify those delivered PO, you can make use of OutStanding Qty Status filter to filter out the completed PO, also completed PO will be highlighted in purple in the report as in the photo below.

8d. How to identify closed PO

Answer:

The difference between Closed PO and completed PO is, the approval status for Closed/Cancelled PO will be in Pending, but for completed PO will be approved(as GRN can be done after PO is approved).

Question 9

What is there are salesman in the system and what is the function of Assign salesman into items?

Answer:

Two types of salesman in EMP, one in document level, another in item level.

Item level salesman is used when you have different category items are covered by different salesmans(e.g. Salesman A sell home entertainment product, Salesman B sell kitchen products), so you can assign different salesman into one invoice in item level. It will help you better allocate salesman effort and their commission.

But if the salesman can covered everything in a bill/invoice, then you need to tick the button, assign salesman to all items of the invoice, then the report will display the sales is under this salesman instead of document level salesman.

Question 10

How to Record New Hire Purchase Motor Vehicle or Fix Asset in Wavelet?

Answer:

1. Create a GL - FIX ASSETS - VEHICLE XXX

2. Create a GL - Current Liability - Hire Purchase Creditor XXX

3. Create a New Supplier and using GL as Hire Purchase Creditor XXX

4. Create a GL - Expenses - Roadtax and Insurance

5. Create a GL - Current Liability - Interest Suspend for XXX

6. Create a GL - Current Liability - AMT-OWING-TO-DIRECTOR(optional)

7. Create a Supplier Invoice - add items

i. VEHICLE

ii. ROADTAX

iii. INTEREST SUSPEND XXX

iv. TOTAL INVOICE - i + ii + iii

8. SUPPLIER INVOICE SETTLEMENT

Director deposits partial funds to company to pay together with company payment voucher for the deposit.(optional)

CREATE RECEIPT VOUCHER, USE GL CODE AMT-OWING-TO-DIRECTOR

I. DEBIT: CASHBOOK,

II. CREDIT: AMT-OWING-TO-DIRECTOR

CREATE PAYMENT VOUCHER TO SETTLE DOWN PAYMENT, TOTAL PAYMENT SHOULD INCLUDE AMT-OWING-TO-DIRECTOR(UNDER NORMAL SITUATION)

9. DO THE MONTHLY PAYMENT TO HP CREDITOR

supplier invoice in 7 - payment voucher in 8 / ( TOTAL MONTH OF INSTALLMENT)

Private & Confidential